- Summary:

- The Rio Tinto share price has rallied in the past few days as investors focus on the rising commodity prices

The Rio Tinto share price has rallied in the past few days as investors focus on the rising commodity prices and the company’s strong earnings. RIO shares are trading at 5,631p in London, which is about 12% above the lowest level this month. The stock remains about 10.45% above the highest point in 2022. So, is Rio Tinto a good investment?

Rio Tinto is one of the leading global mining companies. The firm, which has been around for years, has operations in leading commodity countries like South Africa, Australia, Canada, Madagascar, and Iceland. In these countries, the company extracts top-demand commodities like iron ore, copper, aluminum, and lithium. It also mines diamonds, borates, and lithium. Still, copper and iron ore are the most important products that the company produces.

Rio Tinto share price has benefited from the strong commodity prices, which have pushed its revenue up. In 2021, the company’s revenue soared to $25.35 billion from the previous $15.75 billion. As a result, its free cash flow soared by 88% to $17.6 billion, which helped the company issue a special dividend and reduce its total debt.

The company’s results are expected to be better this year because of the strong demand for commodities. In its results, the firm said that it expects that its capital expenditure for this year will be $8 billion as it seeks to invest in growth and decarbonization. This guidance priced in iron ore trading at $19.5-$21 per tonne.

Rio Tinto share price forecast

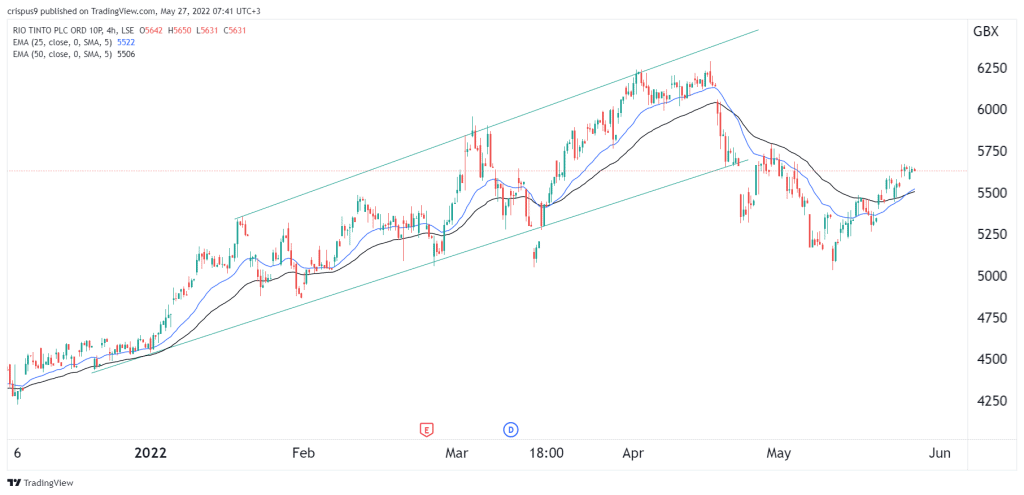

On the 4H chart, we see that the RIO share price has been in a recovery mode after it collapsed to a low of 5,045p earlier this month. The stock has managed to cross the 25-day and 50-day moving averages, which is a bullish sign. At the same time, it has formed an inverted head and shoulders pattern, which is another bullish sign. The Relative Strength Index has kept rising,

Therefore, the Rio Tinto share price will likely keep rising as bulls attempt to retest the YTD high of 6,288p. A drop below the support level at 5,500p will invalidate the bullish view.