- Summary:

- A review of the US NFP and Canada Jobs reports shows a divergence in outcomes, which provided a perfect opportunity to short the USDCAD.

The US and Canada Jobs reports were released simultaneously at 12.30pm GMT. Here is how the numbers played out.

- US Non-Farm Payrolls: 130K jobs were added to the US economy in August, which was far below the 163K jobs that analysts had predicted. Unemployment rate came in as expected: 3.7%. Average hourly earnings came in at 0.4%, which was a tad higher than the last figure/consensus figure of 0.3% growth. This was a disappointing report overall for the USD.

- Canada Jobs report: Employment change showed an addition of 81.1K jobs, which far exceeded the 18.9K jobs that market analysts had predicted. Unemployment rate remained unchanged at 5.7%. This was a stellar report for the CAD.

Trade Play: Sell USDCAD

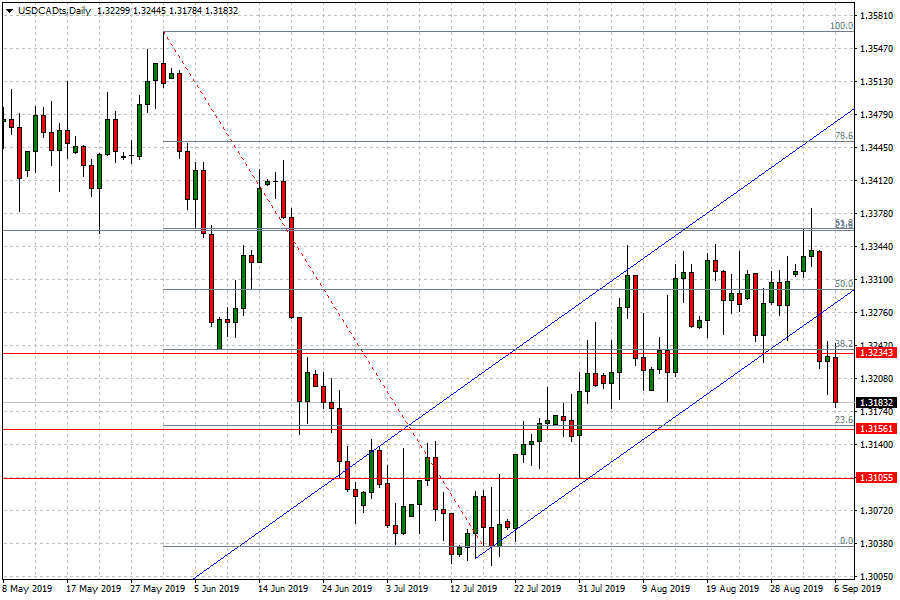

The USDCAD was sold off 1.3339 at news release and is now trading at 1.3183. The next support level lies at 1.3156, which is the 23.6% Fibonacci retracement level from the swing high of March 31 to the swing low of July 18.

If the USDCAD is able to break the support at 1.3156, more downside could follow to 1.3105 (July 18 low).

On the flip side, a failed test of 1.3156 could allow for a pullback to 1.3234 (38.2% Fibo retracement level).