- Summary:

- What is the outlook of the Reserve Rights Token price? We explain whether the token is a good buy and what to expect.

The Reserve Rights price has made a strong bullish comeback in the past few days as investors buy the dip. The RSR token is trading at $0.0065, which is about 81% above the lowest level this month. It has a market cap of more than $117 million. So, is the RSR token a good buy?

Stablecoins have been in the spotlight in the past few weeks following the crash of Terra and its ecosystem. Investors have been mostly worried about the so-called algorithmic stablecoins that are mostly not pegged to real assets like the US dollar. The worry is that these coins can become more vulnerable if more holders start selling them. For stablecoins like USD Coin, such a situation would be easy since they have hard assets.

Reserve Rights Token is a blockchain project that seeks to become a leading player in the blockchain industry. The developers have created the Reserve dollar, which is a stablecoin that is backed by the US dollar 100%. It is widely used in a place like Venezuela which has a problem with hyperinflation. On top of this stablecoin, the developers have built a platform that lets developers build decentralized applications that use the RToken. RSR has two main roles in this ecosystem. It helps to insure reserves stablecoins and ensures governance of the ecosystem.

Reserve Rights price prediction

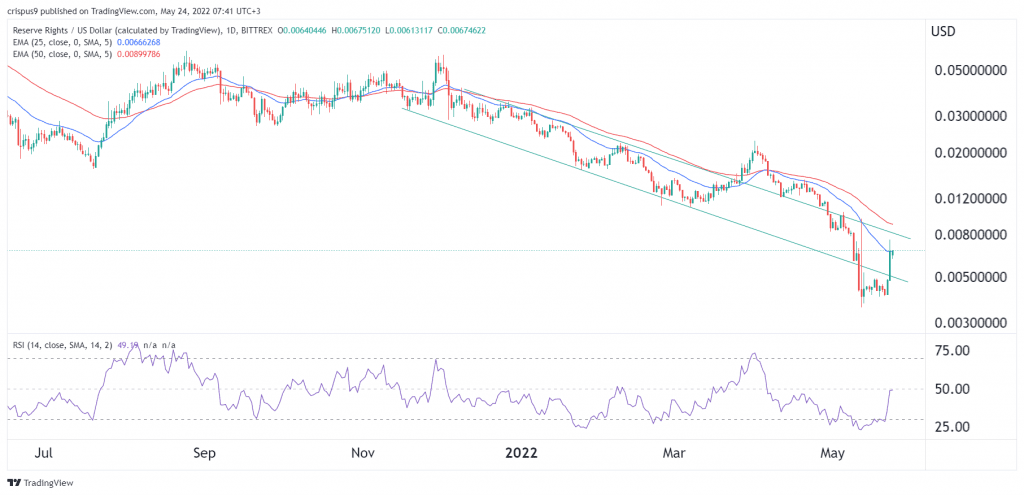

On the daily chart, we see that the RSR token has made a strong comeback in the past few days. It has crashed by more than 93% from its all-time high. It has moved slightly above the descending trendline shown in green. The coin has moved above the 25-day moving average while the Relative Strength Index (RSI) has moved to the neutral level of 50.

It is slightly below the upper side of the descending channel. Therefore, there is a likelihood that the Reserve Rights price will retest the important resistance level at $0.0085. A drop below the support at $0.0055.