- Summary:

- Reliance Industries share price has crawled back recently. The stock rose to ₹2,600, which was about 10% above the lowest level in July

Reliance Industries share price has crawled back in the past few days. The stock rose to ₹2,600, which was about 10% above the lowest level in July this year. However, this price is about 10% below the year-to-date high of ₹2,812. The company has a total market cap of over 17.53 trillion rupees or $220 billion, making it the biggest firm in India.

Reliance Industries is a leading company that operates in different segments. Its key segments are exploration and production, petroleum refining, new energy, textiles, retail, and telecommunication. The company has done well in the past few months, helped by the discounted crude oil it has been buying from Russia.

In July, the company said its net income jumped by 46% in the three months to June 30th. Its profit was over $2.3 billion as its revenue jumped by 55% to 2.23 trillion rupees. At the same time, total costs rose by 51% to 1.98 trillion rupees.

The company also spent billions of dollars at a recent spectrum auction as it seeks to grow its market share. At the same time, it hopes to become a leading player in green energy by investing $76 billion. For example, it is building four gigafactories for making products for green hydrogen, solar modules, fuel cells, and storage batteries.

Reliance Industries share price forecast.

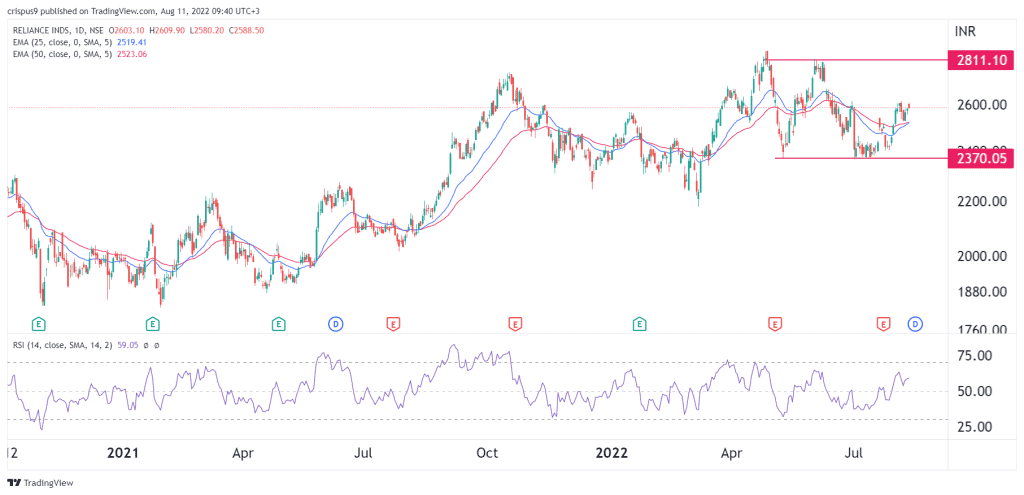

The daily chart shows that the RII share price found a strong support level at ₹2,370 this year. It struggled to move below this support point in May and July 6th. However, it has now bounced back and moved slightly above the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has moved slightly above the neutral point.

Therefore, Reliance shares will likely continue rising as buyers target the important resistance point at ₹2,811. This price is about 8.1% above the current level. A move below the support at ₹2,516 will invalidate the bullish view.