- Summary:

- Rabobank economists say that they are expecting a pullback in the EUR/USD in Q1 2021, but this may not last as inherent USD strength may not be seen soon.

The EURUSD came under pressure this Thursday after Rabobank downgraded bullish prospects on the pair. Economists at the bank foresee a correction on the pair in the 1st quarter of 2021. They attribute this to the uncertainty posed by the coronavirus 2nd wave and the various lockdowns across Europe.

Rabobank’s analysts do not see too much of a downside on the pair, as bullish sentiment on the USD is expected to return only if the Fed raises interest rates. At this time, this is not an immediate priority for the Fed.

Technical Levels to Watch

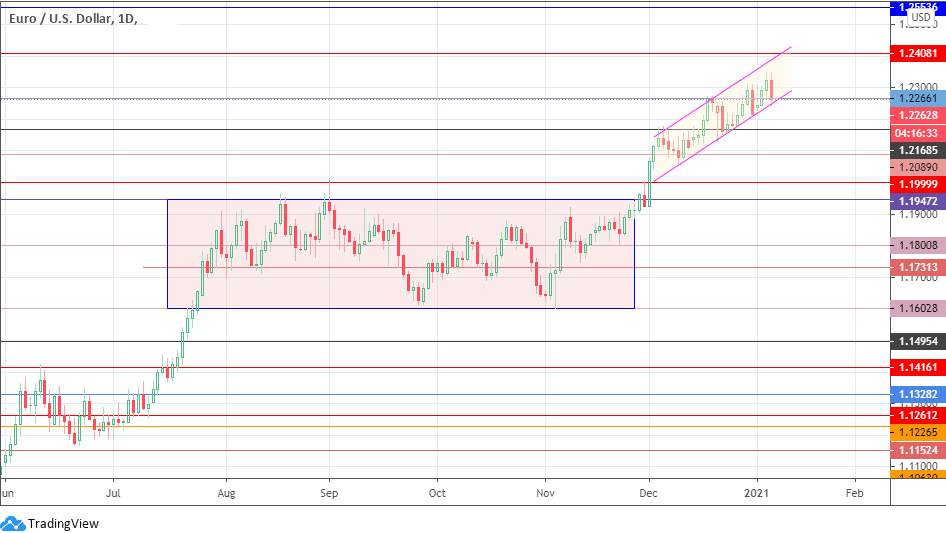

Bulls on the EURUSD would be hoping for a bounce on the 1.22661 support (which intersects the lower boundary of the ascending channel). This bounce would open the door towards the March 2018 highs at 1.24081. The 12 February 2018 high at 1.25536 is also a potential upside target if bulls can take the EURUSD beyond 1.24081.

On the flip side, a breakdown of the channel’s lower border could open the door for a drop towards 1.21685, with 1.20890 and 1.19999 serving as additional downside targets.

EUR/USD Daily Chart