- The Procter & Gamble share price is at risk of further declines as the cost of doing business rises. The PG stock price is trading at $145

The Procter & Gamble share price is at risk of further declines as the cost of doing business rises. The PG stock price is trading at $145, which is about 12% below the highest level this year, meaning that the company is in correction territory. Its market cap has dropped to over $350 billion. Other consumer staples stocks like Unilever and Clorox have all retreated.

Procter & Gamble is a large consumer staples company that manufacturers some of the best-known products worldwide. Its products are in categories like baby care, fabric care, family care, grooming, and oral care, among others. Its top products are Luvs, Arial, Tide, Always, Gillette, and Pantene, among others.

The Procter & Gamble share price rose sharply after the company published its quarterly results. The company surprised investors by saying it had managed to weather the inflation by boosting prices. However, there are concerns about how high the company will be able to hike prices, considering that inflation is continuing.

Another concern is that consumer spending will continue slowing down as prices rise. However, this concern is offset by the fact that most of its products like Always, Gillette, and Arial are things that people cannot do without. Further, P&G will likely be able to maintain higher prices when inflation starts cooling.

Procter & Gamble share price forecast

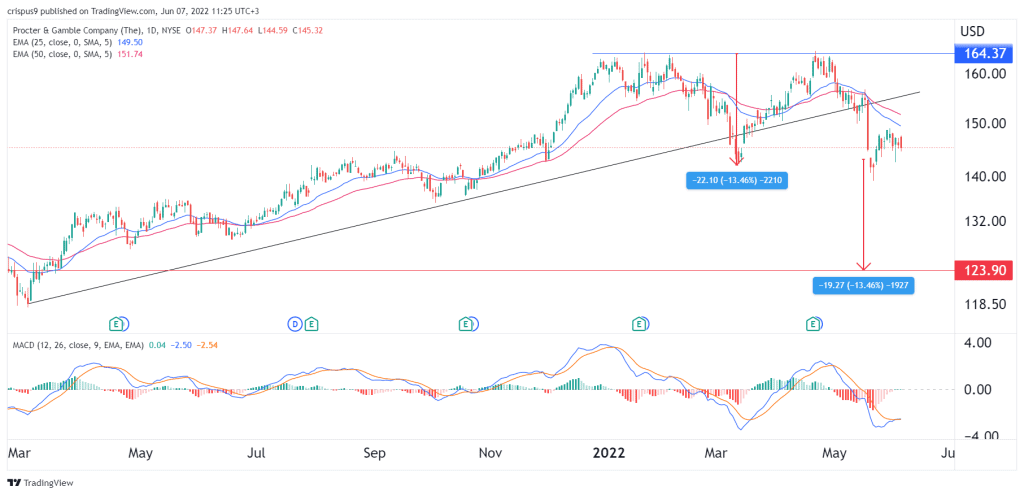

The daily chart shows that the PG stock price has formed a strong double-top pattern. In price action analysis, this pattern is usually a bearish sign. At the same time, the stock has crashed below the 25-day and 50-day moving averages, while the MACD has moved below the neutral level. It is also below the ascending trendline shown in black.

Therefore, the stock will likely have a major bearish breakout, with the next key level to watch being at $123. This price is equivalent to the upper side of the double-top pattern and its chin.