- Polygon Matic price is on a long-term bullish trend, with today’s price surge of 3 per cent marking the third consecutive day.

Polygon Matic price is on a long-term bullish trend, with today’s price surge of 3 per cent marking the third consecutive day the crypto is gaining in the markets.

Polygon Price Prediction

Polygon being part of the Ethereum network, is seeing increased interest for the past few trading sessions. Part of the reason for this is due to the upcoming Ethereum merge, which is scheduled for next. The merge will see Ethereum move from a proof-of-work platform to a proof-of-stake platform.

The result of the merge is likely to send not only Ethereum prices high but also cryptocurrencies such as Polygon Matic. Therefore, investors are looking for such projects that they are anticipating will grow due to the merger and buying investing in them.

The Polygon Matic platform has also been busy releasing new upgrades, which is making everything in Ethereum run better. In fact, Polygon Matic is generally referred to as a scalability solution for Ethereum due to its vast functionality that you cannot find in Ethereum. All these factors are important when looking at where to expect the price of Polygon Matic in the next few trading sessions.

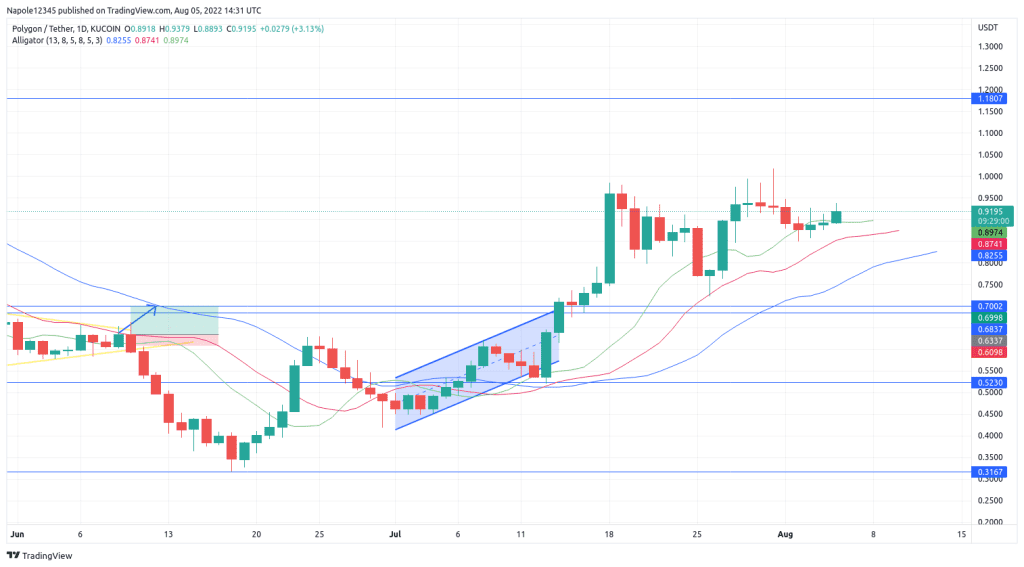

Looking at the chart below, today’s 3 per cent price gain is an early signal of what is about to come. Since June 19, Polygon Matic has gone up by 190 per cent, and the current bullish trend indicates the long-term is likely to continue. With the upcoming merge of the Ethereum platform, my Polygon Matic price prediction does not expect the prices to change the current trend and move downwards.

Therefore, expect the prices to trade above $1 within the next few trading sessions. There is also a high likelihood that the prices will continue rising and hit the $1.18 resistance level and possibly break to the upside and trade above $2.

My analysis will, however, be invalidated should the prices trade below this week’s price low of $0.84. At that point, a possible push to the downside will not be out of the question.

Polygon Matic Daily Chart