- Polkadot price has already surged by 50% in 2023. Latest analysis shows DOT crypto can still go up another 50%.

Polkadot price (DOT-USD) has generated massive gains since the start of 2023. The price is currently 50% up from its December 2022 lows. Our analysis suggests that DOT price can still surge by another 46% if a few conditions are met.

On Wednesday, crypto markets turned green once again as the Bitcoin price rose by 3%. This makes it the first green day of the week as the price of biggest cryptocurrency fell at the start of the week. Polkadot price is also 3.43% up for the day after tagging the $6.276 level last night. If you’re wondering where to buy Polkadot, then you need to sign up on Binance, which will take a few minutes.

Polkadot Latest News Today

According to the most recent Polkadot news, the team is hosting the ‘BUIDling the Multichain’ summit at the ETH Denver today. The summit will feature panels and talks that will guide the dapp developers to harness the true power of blockchain. In other news, the anonymous winner of the 39th parachain auction has also revealed its name.

The latest parachain project is known as Manta Network. It is an on-chain privacy solution provider protocol that will reside on Polkadot as 1 of its 100 parachains. Moonbeam is an EVM-compatible layer on Polkadot which is currently the biggest parachain in terms of TVL. Currently, $83 million is locked on this parachain across different dapps like Moonwell Artemis, Stella Swap, Lido, etc.

Polkadot Price Prediction – 1D Chart

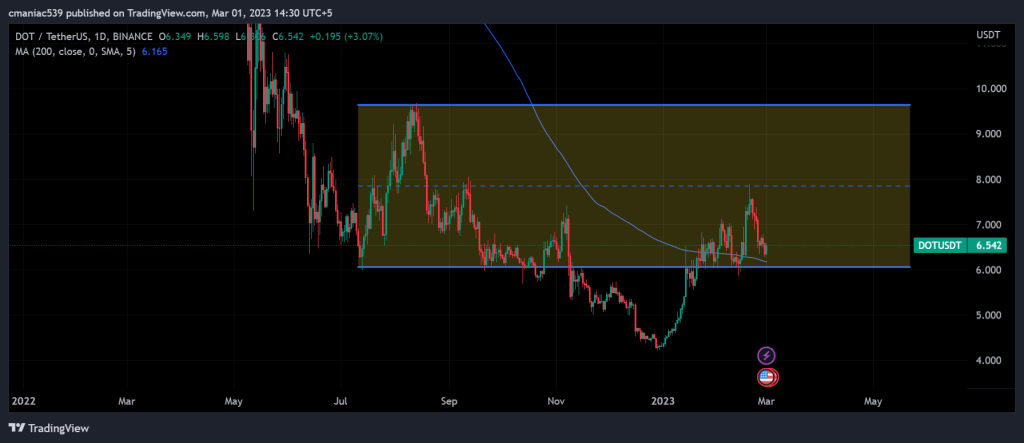

On 1D timeframe, DOT crypto is still bullish, despite a significant correction. The following chart shows the range in which the price has been trading for the past few months. Recently, the Polkadot price got rejected from the mid of range, which lies at $7.85.

However, the market structure still looks strong enough to restest the range mids once again. A reclaim of $7.85 level will make Polkadot price prediction even more bullish. In this scenario, I expect the DOT/USD price to tag range highs that lie at the $9.5 level. However, a daily close below 200-day MA will invalidate this prediction.