- Platinum price held steady as precious metal prices bounced back following the latest US inflation data. It rallied to a high of $950

Platinum price held steady as precious metal prices bounced back following the latest US inflation data. It rallied to a high of $950, which was the highest point on June 21st of this year. It has jumped by more than 13.5% from its lowest level this year. This price action is in line with that of other precious metals like gold and palladium.

Weaker US dollar

Platinum price continued its strong comeback as investors focused on the relatively weak US dollar following the latest inflation data. The numbers showed that the country’s inflation eased slightly in July this year as the price of gasoline declined. The average gasoline price dropped from the year-to-date high of $5 per gallon to about $4.

Platinum and other precious metals tend to do well in a period when the US dollar is relatively weak. Indeed, the dollar index declined from the year-to-date high of $109.30 to a low of $104.30. This happened as investors started to price in a situation where the Federal Reserve slows the pace of tightening.

Still, in separate statements, Charles Evans and Neel Kashkari said that the bank will continue tightening in a bid to lower inflation. The base case is that the bank will hike rates by 0.50% in September followed by two 0.25% in the final meetings.

Platinum price continued rallying as investors reacted to the upbeat trade numbers from China. The country’s exports did well in July while imports rose at a slower pace. As a result, the country’s trade surplus widened to over $100 billion.

Platinum price forecast

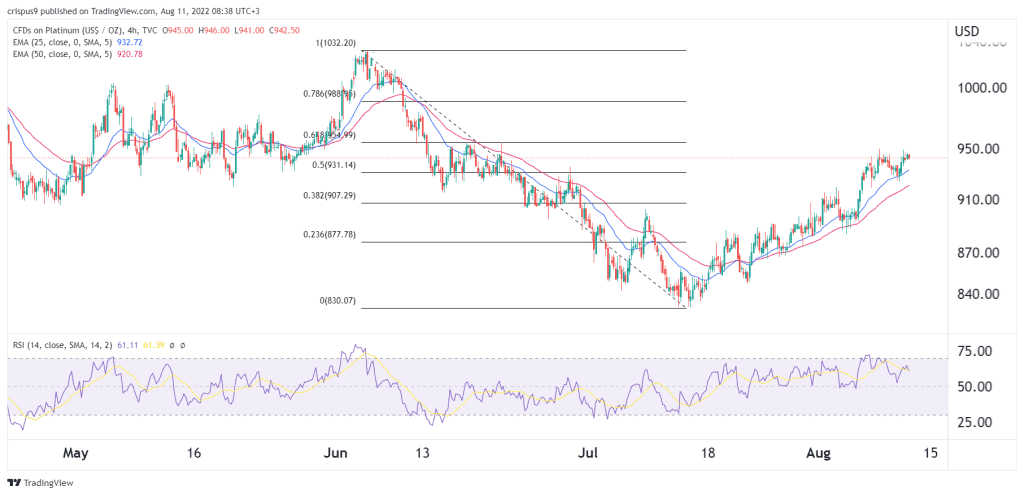

The four-hour chart shows that platinum has been in a strong bullish trend in the past few weeks. Along the way, the metal moved above the 25-day and 50-day moving averages. It has managed to move above the 50% Fibonacci Retracement level while the Relative Strength Index (RSI) has moved slightly below the overbought level.

Therefore, platinum will likely continue rising as buyers target the next key resistance at $1,000. A move below the support at $920 will invalidate the bullish view.