- Summary:

- The platinum price is inching towards 9-month highs as expanding sanctions on Russian producers bites harder.

The Platinum price surged on Friday, notching up gains of 2.04% as of writing as commodity prices responded positively to the growing escalation of the Russia-Ukraine conflict. Expanding sanctions are hitting Russian commodity interests hard, and the ever-increasing supply constraints are putting upward pressure on prices.

Several Russian companies with business interests in commodities are losing their status on Europe and the UK exchanges. In the UK, Polymetal and Evraz are due for delisting from the FTSE 100 on Monday after remarkable selloffs have wiped out more than two-thirds of their value in just a few trading days. There is also a growing buying apathy towards Russian-sourced commodities.

Thirty-one Russian companies are listed on the London Stock Exchange, with a combined value of £468bn. One company in focus is Norisk Nickel (Nornickel), a company that is partly owned by Russia’s UC Rusal and accounts for 10% of global platinum mine production. Expanding sanctions could mean that more Russian-linked commodity firms could find it harder to sell products, leading to the kind of surges seen this week in the platinum price.

Platinum Price Outlook

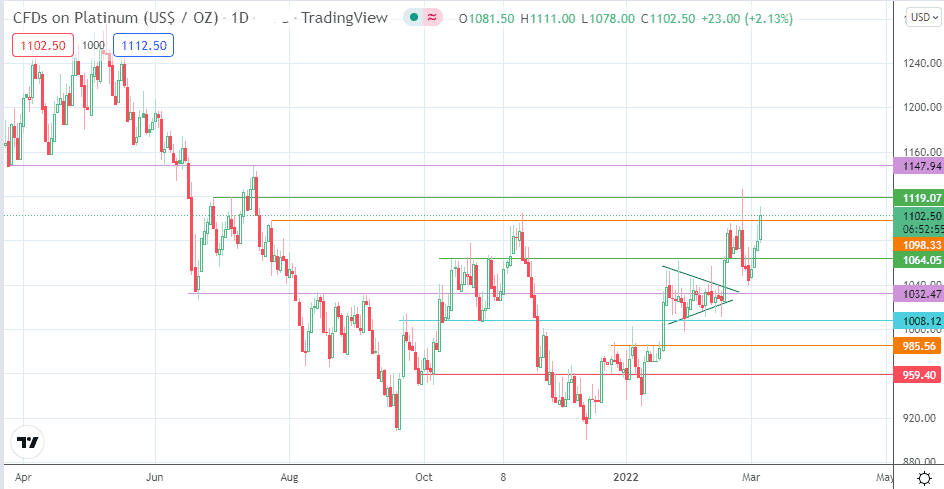

Friday’s surge has violated the 1098.33 resistance. A 3% penetration close above this level is required to confirm the breakout and send the metal towards the 1119.07 resistance, recently tested unsuccessfully on 24 February. If this barrier gives way, then 1147.94 (26 March/4 June 2021 lows and 15 July 2021 high) becomes the immediate target after this new break.

However, reference must be made to the now completed bullish pennant and its completion point at the 1119.07 resistance. If there is a retreat from that point due to another failed break attempt, then 1064.05 would be a potential target to the south if the bulls fail to contain the decline at 1098.33. 1032.47 (13 August/3 September 2021) forms another downside target for the bears if the decline continues.

Platinum: Daily Chart

Follow Eno on Twitter.