- Summary:

- Platinum price forecasts indicate that the stall at 903 could provide a temporary rally on which sellers may profit from.

The Platinum price forecasts appear to be heading to the bullish end of the spectrum as the XPT/USD pair gains 0.39% this Tuesday. This follows three previous attempts to break down a key support level at 903.76, two of which resulted in the formation of pinbar candles that closed above this support.

Platinum prices are well off from their 2021 highs when resurgent demand from China following the reopening of its economy sent prices to new all-time highs. However, following a period of correction and push to the north in early 2022, the emergence of the Omicron variant of COVID-19 in China and accompanying lockdowns of Shanghai and other provinces shut down demand for platinum. This brought bearish Platinum price forecasts into the market as prices fell from $1177 on 9 March to the current lows around $900.

The stall in the downside move follows China’s lifting of the Shanghai lockdowns, creating hopes of fresh demand from China’s industrial zone. Also, propping up prices this Tuesday is the risk-on sentiment with which the markets have begun the week. This has seen risk-sensitive commodities putting on some gains.

However, the overall market sentiment remains tilted to the side of USD bullishness on the back of hawkish Fedspeak. This means rallies may become new selling opportunities, which could spur new platinum price forecasts to the downside.

Platinum Price Forecast

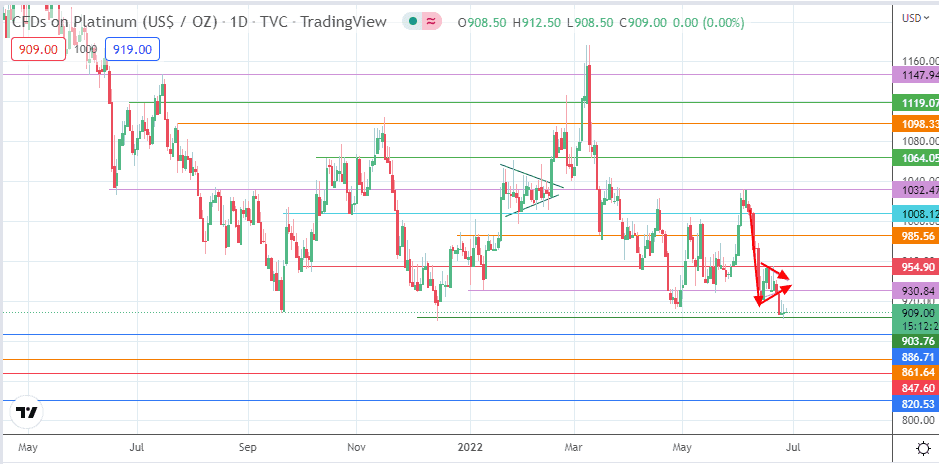

The recent decline on the platinum price chart comes off the breakdown of the bearish pennant. However, the attempt by the price action to aim for the measured move’s completion point at 861.64 appears to have stalled at the 903.76 support (15 December 2021 low).

If the bulls can resist a further slide at this support and initiate a bounce, a retest of 930.84 as a resistance target comes into play. However, a further advance will give the bulls access to the 954.90 barrier (27 May and 21 June 2022 highs). Additional northbound targets above this level are seen at 985.56 and 1008.12 (28 October 2021 and 7 June 2022 lows).

On the other hand, a decline below the 903.76 support continues the bearish pennant’s measured move, allowing the bears to aim for the 886.71 price pivot, the site of a previous low seen on 30 July 2020 and 4 September 2020.

Below this level, additional support comes in at 861.64 (21 September 2020 and 11 November 2020 lows). Other harvest points for the bears which enter the picture on further price deterioration are 847.60 (6 October 2020 and 2 November 2020 lows) and the 13 July 2020 low at 820.53.

XPT/USD: Daily Chart