- Summary:

- The Pinterest share price has been attempted to recover after the strong crash that happened in May this year.

The Pinterest share price has been attempted to recover after the strong crash that happened in May this year. The PINS stock is trading at $19.65, which is about 21% above the lowest level in May. However, the shares remain about 78% below its all-time high, bringing its total market cap to more than $13.45 billion. This is a notable amount considering that PayPal was considering acquiring the company for more than $40 billion.

Pinterest and other social media companies came under intense pressure in May for a number of reasons. First, in a surprising announcement, Snap announced that it will have lower revenue and profitability this year. As such, investors believe that other social media firms like Pinterest, Meta Platforms, and Twitter will see lower numbers.

Second, as a growth stock, Pinterest stock price declined sharply as the Fed embraced a more hawkish tone. The bank decided to hike interest rates by 0.50% and hinted that it will start reducing its total balance sheet in a process known as quantitative tightening. As a result, most growth stocks declined sharply in May.

Third, there are concerns that inflation will continue affecting companies. The main catalyst for this was the weak earnings by retailers like Walmart, Target, Kohls, and Bed Bath and Beyond. These companies warned that inflation was having an impact on their industries.

Pinterest share price forecast

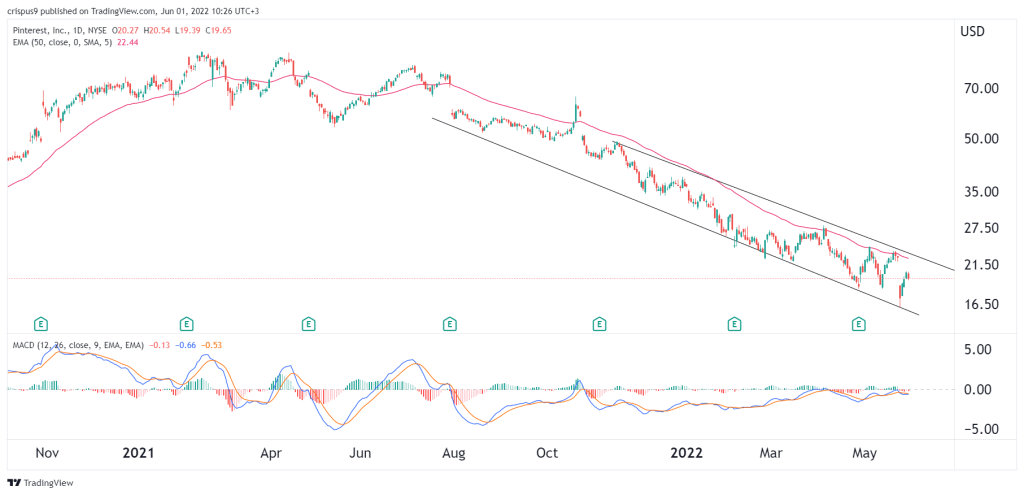

The daily chart shows that the PINS stock price has been in a strong bearish trend in the past few months. The chart has formed a descending channel that is shown in black. The shares are between this channel while the stock has moved below the 25-day and 50-day moving averages while the MACD has moved below the neutral level.

Therefore, the Pinterest share price will likely keep falling as bears target the key support at $16, which was the lowest level this year. A move above the resistance at $22 will invalidate the bearish view.