- Summary:

- The palladium price action has hit 14-week highs, but could be due for a correction if the bears reject the uptick at the current resistance.

The Palladium price action on the XPD/USD chart indicates that the metal has added 0.69% on the day, marking the second day of modest gains and a fifth green day in six. However, the thinning volumes on the bullish side of things may cause some concern if the emerging pattern is anything to go by.

Palladium prices have been in recovery mode following the easing of China’s COVID-19 cases caused by the Omicron variant, which had led to a controversial zero-COVID policy and new lockdowns that threatened demand for industrial metals. An uptick in Chinese car purchases and Tesla’s standout earnings are also responsible for the latest demand for Palladium. Palladium prices are closing in on 14-week highs due to the latest uptick.

Supporting a further uptick would be a weakening in the US Dollar index following the easing of consumer prices. This would blight the chances of further aggressive Fed rate hikes and stave off fears of a recession. Sustaining the demand for electric vehicles heading into the winter would also be a strong tailwind.

However, there are always background fears of China’s COVID-19 situation staging a comeback with attendant restrictions. The recent discovery of an animal-borne virus in 35 new human viral infections in China within the last two days is a constant reminder that metal traders must constantly watch their backs. The latest news could be grounds for a correction, which could escalate into a full-scale selloff if the 2146 barrier is breached to the downside.

Palladium Price Forecast

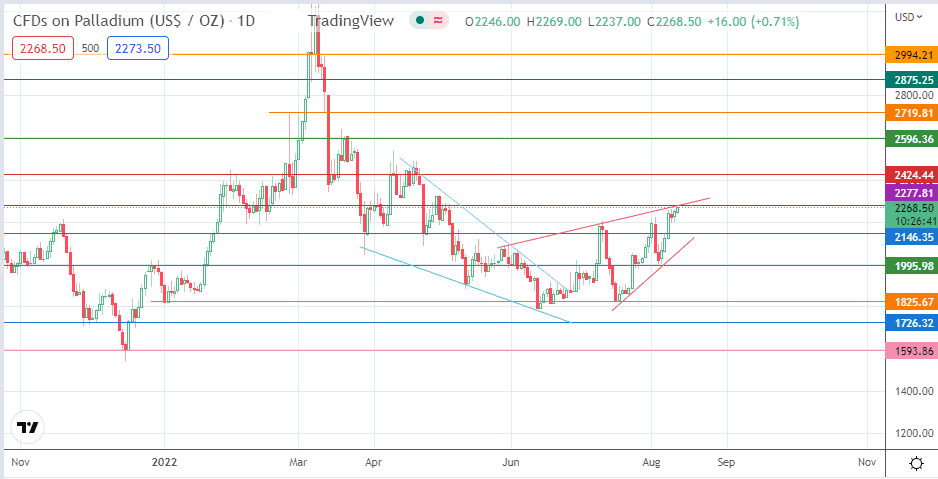

The conclusion of the falling wedge (blue colour) seems to tally with the evolution of the rising wedge, with the price action currently testing the 2277 resistance, which marks the end of the first wedge’s completion move. A break above this barrier negates the rising wedge, opening the pathway toward the 2424 resistance initially (22 February and 13 April 2022 high). If the advance continues, the 2596 barrier formed by the 21 March high enters the mix as an additional target before 2719 becomes available.

This outlook is negated if the bears resist the advance at the 2277 resistance, where the rising wedge’s upper border is found. The accompanying pullback brings in the lower edge of the wedge at 2146 into the mix as the next target in line. The wedge’s evolution will be completed if this support breaks down. The bets would be on for attaining the measured move at 1825 if the bears breach the pivot at 1995. The 1 December 2021 low at 1726 comes into the picture if there is further price deterioration.

XPD/USD: Daily Chart