- Summary:

- The Australian Employment data will be released at 1.30am, posing a tricky performance situation on the Aussie Dollar after the US FOMC decision.

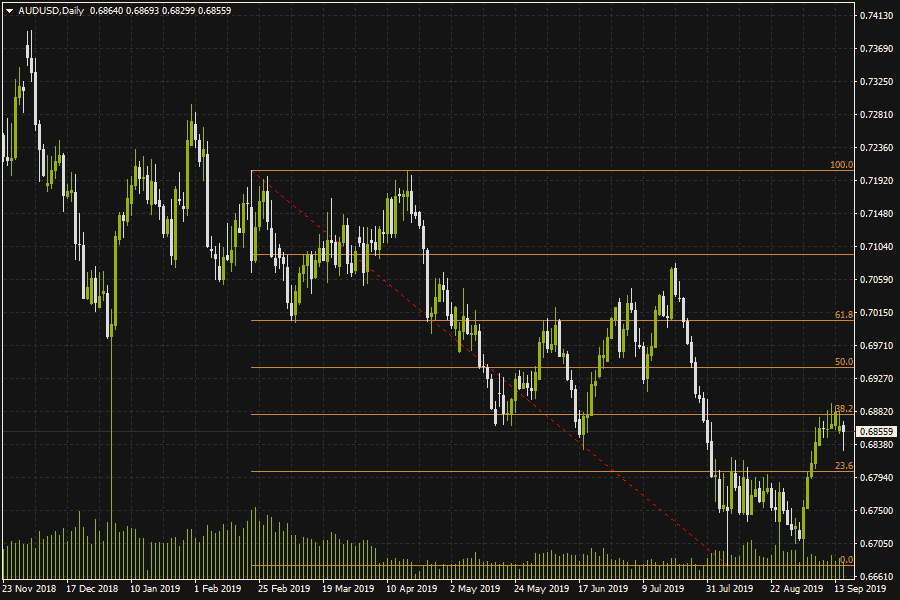

As the Australian Employment data looms, the Aussie Dollar has lost ground on the day a result of dovish minutes from the Reserve Bank of Australia in yesterday’s Asian session. As a result, the pair broke below the consolidation cluster around the 38.2% Fibonacci level derived from the swing high of February 21 to the swing low of August 7. This has dragged the pair down even as the Stochastics oscillator has left the overbought region and has started to head south.

Trading the Australian Employment Data

The Australian Employment data will be released at 1.30am GMT on Thursday. This is a two-pronged news release that is made up of the employment change data and the unemployment rate. Employment change is expected to come in at +15,200, with unemployment rate expected to remain at 5.2%.

The previous figure was +41.1K for the employment change. This gives a deviation of 25.9K. If the employment change is negative, a further selloff on the AUDUSD would be on the cards. Sentiment is already negative and the AUDUSD is down 40 pips on the day. The nearest support currently lies at the 23.6% Fibonacci retracement. Below this level, support can also be found at 0.67462.

If the employment change surprises to the upside, especially if the figure comes out at +67K and higher, this could lead to a good recovery on the pair in the near-term. However, this recovery may be transient if sellers see this as an opportunity to initiate shorts at cheaper prices.

The pair may be subjected to some shocks from the FOMC interest rate decision. It may be good to watch out for divergence of outcomes here.

A good trade setup would be to go short if the USD gains on the FOMC decision, and the Australian Employment Change disappoints to the downside. The opposing setup would be to buy AUDUSD if the FOMC decision is disappointing for the US Dollar, and the Employment data comes out good for the Aussie Dollar.