The 6.11% spike in the OGN/USDT pair has reinforced near-term bullish Origin Protocol price predictions as the pair seeks to retest its most recent high at the 0.3827 price level.

The OGN/USDT pair started the week on a strong note, but a spike to 0.3827 was quickly reversed by the bears, with subsequent daily action forcing a 3-day losing streak on the stock. Friday’s uptick is an attempt to recover from these lows, but the pair looks set to end the week lower. This will break a 3-week winning run, something many altcoins have been unable to do.

The OGN/USDT pair has fared better than many altcoins since the middle of June. Recent interest in its stock driving bullish Origin Protocol price predictions appears to be linked to the pre-launch of its Origin Dollar Governance (OGV) liquidity mining campaign, which took place in early July. Fifty million OGV tokens were allocated for this campaign, with subscribers needing to hold for seven days to claim eligibility.

The Origin Protocol is an Ethereum-backed NFT and DeFi platform with two tokens. The OGN token is the governance token for the NFT platform Origin Story, while the OGV token will be the governance token for its yield-generating stablecoin OUSD. OGV will be allocated to those who can add liquidity to OUSD.

Origin Protocol Price Prediction

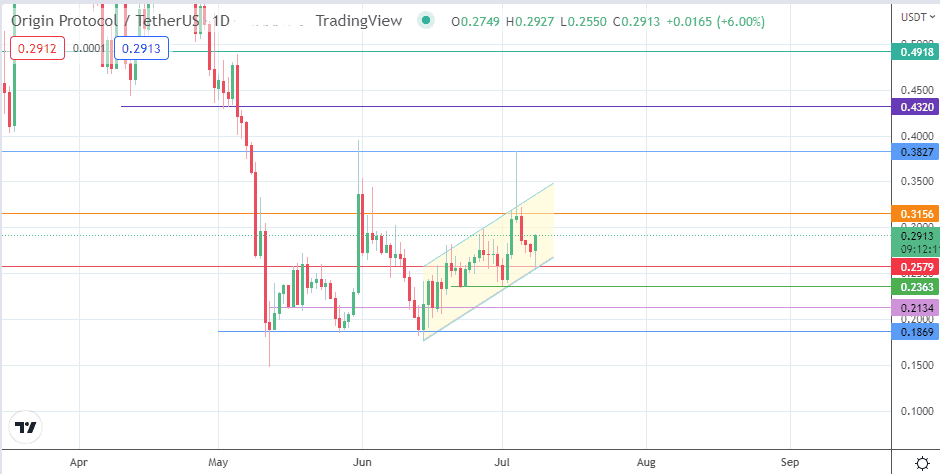

The intraday bounce off the 0.2813 price mark also takes the pair off the channel’s trendline. This double support has given the price action the prop to take on the 0.3156 resistance (2 June 2022 high). Above this level, the 0.3827 resistance formed by the 4 July high forms the next target for the bulls. Additional targets to the north at 0.4320 (3 March low) and 0.4918 (12 April 2021 high) become available if the price action advances further.

Conversely, the bears would take control if the bulls fail to defend the double support at 0.2579. This decline makes 0.2363 immediately available, being the site of previous lows of 23 June and 1 July 2022. Additional targets to the south are found at 0.234 (17 May and 17 June lows) and at 0.1869 (13 May and 27 May lows).

OGN/USDT: Daily Chart