- Summary:

- Origin protocol price has been on a strong uptrend over the past week. What are the chances it can sustain this action?

Origin protocol price has been on an ascending trajectory over the past one week, and it seems to have gone against the grain even as the crypto market experiences headwinds. The DeFi-centric platform has gained about 45% in the last seven days, while the general market trend has been heading south. Also, the OGN price has risen by about 21.5% in the last two weeks, underlining a stable momentum. However, OGN is still below its 30-day high by about 21%.

OGN vs the crypto market

The crypto market has struggled to sustain its gains at the beginning of April. Bitcoin price, which is widely taken as the barometer for the overall market, went below $40K this week, driven by selloffs. According to crypto analytics firm, DappRadar, DeFi lost about 8.4% of its value in Q1 of 2022. That was a significant loss but far much smaller than the token market, which lost about 50% of its value.

After initially registering losses in eight of the first twelve days of April, Origin Protocol price has rebounded and gained in six of the last seven days. Notably, the DeFi sector is upbeat, and many DeFi projects continue to raise millions of dollars in venture capital. Therefore, as the governance token of the DeFi-centric Origin Protocol, OGN is likely to continue registering significant gains.

Origin Protocol price prediction

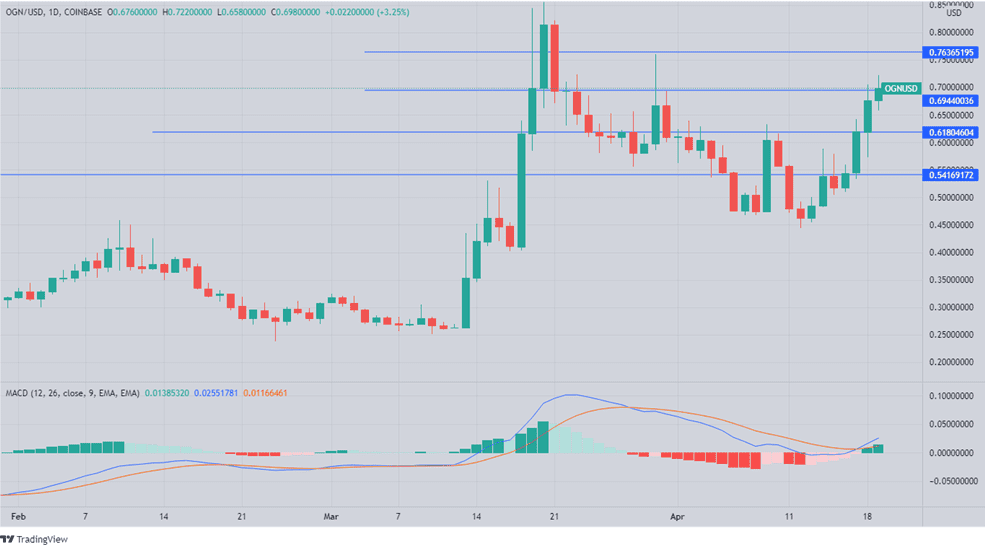

The Origin Protocol Price has been trending upwards in the last week and has built a strong momentum. The MACD line is above the signal line, which builds a strong case for gains. Based on the current momentum, the price is likely to rise to $0.7636, with the support at $0.6944. If the momentum declines, the first support will likely be at $0.6180. Beyond that point, the support could slip further down to $0.5416, which will invalidate the $0.636 target.