- Summary:

- The Ocado share price is up slightly this Wednesday as investors hail the new carbon dioxide cleanup deal with Climeworks.

There is increased demand for Ocado stocks, as the company has committed to a massive step towards reducing its carbon footprint on the planet.

The Ocado share price is up 0.5% this Wednesday, on news of a partnership between Ocado and Climeworks to provide funding for the removal of 1,000 tonnes of carbon dioxide from the atmosphere.

Climeworks is a direct air capture technology provider which has won the contract from Ocado to use its modular collectors to clear the equivalent of what Ocado Retail will produce in terms of CO2 emission over the next seven years. The deal is being hailed as a world first, and it is part of Ocado’s commitment to becoming a zero-net emitter of CO2 by 2040.

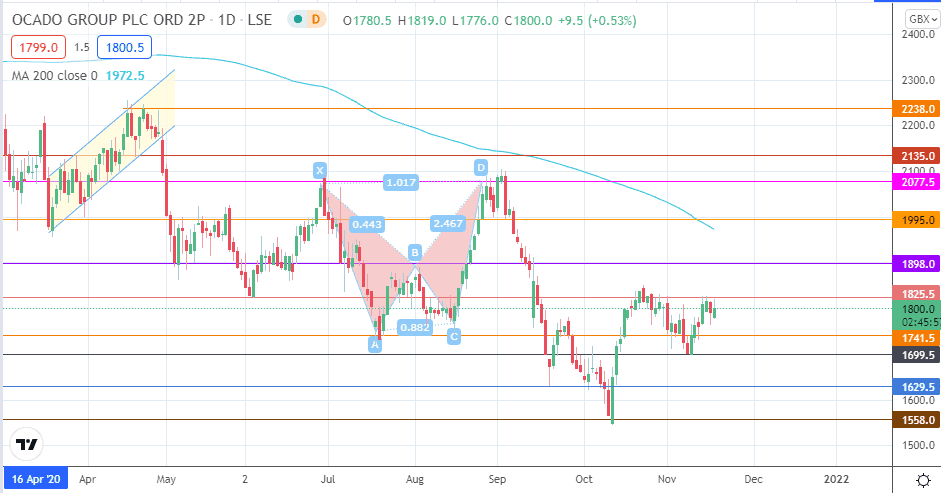

Ocado Share Price Outlook

The 28 April 2020 high/9 November low at 1699.50 is the pivot for the current price recovery. This move has taken out 1741.5 and is now challenging the 1825.5 resistance (4 June low). A break of this resistance allows 1898.0 to enter the picture as a new upside target. 1995.0 and the 200-day moving average are the additional barriers to the north.

On the flip side, rejection at 1825.5 allows for a retest of the 1741.5 pivot. A breakdown here allows 1699.5 into the picture once more, with 1629.5 and 1558.0 lining up as potential targets to the south.

Ocado: Daily Chart

Follow Eno on Twitter.