- Summary:

- The Ocado share price popped on Tuesday as investors reacted to the latest expansion plans by Kroger, the giant American supermarket.

The Ocado share price popped on Tuesday as investors reacted to the latest expansion plans by Kroger, the giant American supermarket. The stock jumped by more than 5.75%, becoming the best performing stock in the FTSE 100 index.

Kroger and Ocado

Ocado is one of the biggest technology companies listed in the UK. The company offers logistics and warehouse services in the UK and around the world.

In the UK, it works through its joint venture with Marks and Spencer, the well-known retailer. Internationally, it partners with retailers like Kroger. It provides them with services like warehousing and logistics.

The Ocado share price has crashed by more than 40% from its highest level this year. This happened as investors remained concerned about its growth prospects as countries intensify their vaccine rollouts and as more people shift from online shopping.

Also, investors were relatively concerned about the company’s lack of profitability. While its top-line growth has been relatively okay, its bottomline has underperformed. For example, the company has made limited profits in the past decade.

The OCDO share price jumped on Tuesday after Kroger announced new plans to expand its business in the Northeast through its partnership with Ocado. Ocado will offer its automated customer fulfilment center (CFC) to fill orders for same day and next day delivery. It will also open two CFCs in South California and Florida. In a statement, the company’s CEO said:

“Kroger Delivery is a thriving part of our dynamic ecosystem and is transforming grocery e-commerce and meeting a range of customer needs through the introduction of first-of-its-kind technology in the U.S. developed by Ocado”

Ocado share price forecast

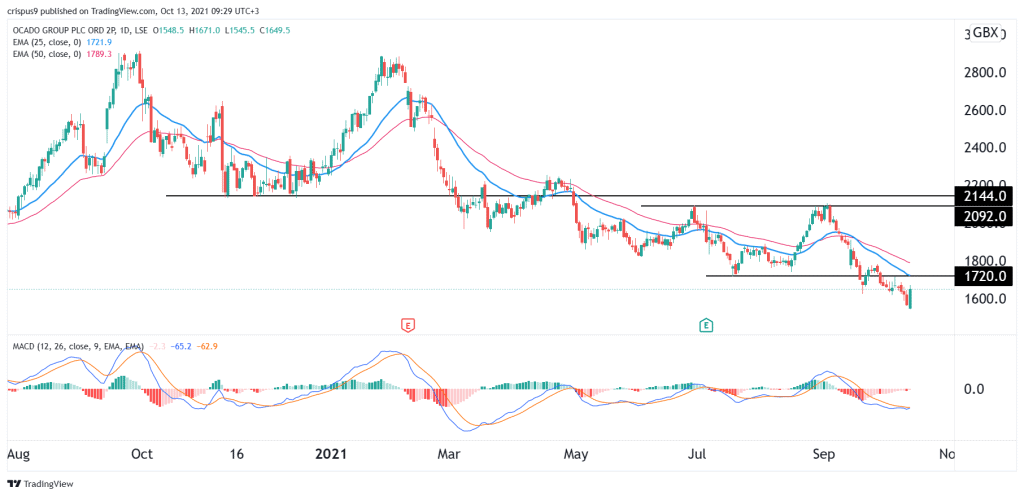

The daily chart shows that the Ocado share price has been in a major sell-off in the past few months. And recently, the stock managed to move below the key support level at 1,720p, which was the previous YTD low.

Now, the shares seem to be forming a break and retest pattern, which happens when an asset’s price retests a key level. At the same time, the stock’s bearish trend is being supported by the 25-day and 50-day moving averages.

Therefore, the shares will likely resume the downward trend as the excitement about the Kroger deal fades. This view will be invalidated if the price moves above the key resistance at 1,800p.