- Ocado share price has struggled in the past few days as concerns about the company’s recovery and growth continue.

Ocado share price has struggled in the past few days as concerns about the company’s recovery continue. The OCDO stock is trading at 835p, which is slightly below last week’s high of 871p. It has fallen by almost 50% from its highest level in 2022 and has underperformed the FTSE 100 and FTSE 250 indices. Other UK retail stocks like Tesco and Sainsbury have also declined this year.

Ocado growth slowing

Ocado is a leading e-commerce and logistics company that annually serves millions of people. The firm serves customers directly through its partnership with Marks and Spencer. It also provides services to retail companies like Kroger. These firms outsource their warehouse solutions to Ocado. As such, it has become one of the most important companies in the industry.

Ocado has been successful, especially in the UK, where it is a well-known brand. However, the company has also had many issues. Most importantly, it is a money pit that has lost billions of dollars in the past few years. The management has always insisted that this spending was necessary as it seeks to fund growth. It expects to become profitable in the coming years.

Ocado is promising to increase its growth phase. Recently, the firm raised over $500 million from investors through debt to fund its expansion. However, many investors believe that Ocado should instead start focusing on profitability instead of growth. This explains why the OCDO share price has crashed in the past few months.

Ocado share price forecast

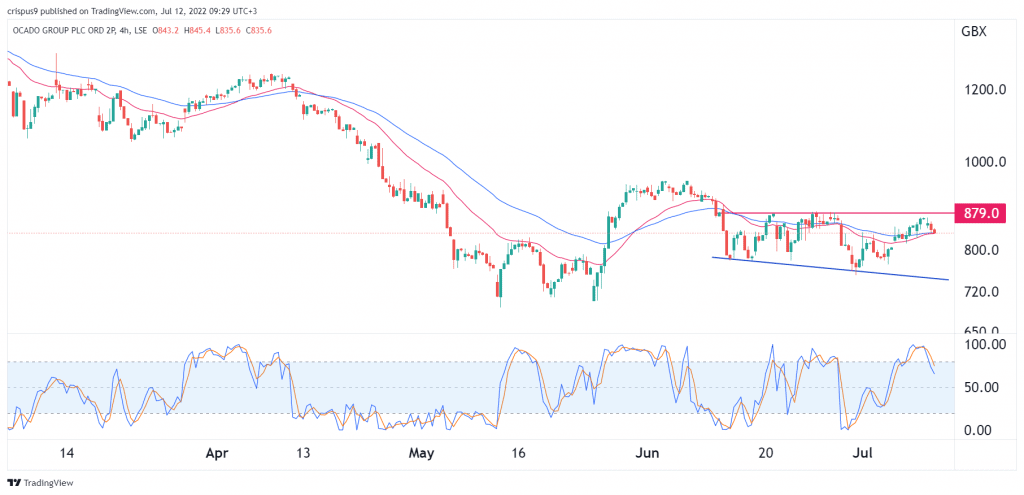

The 4H chart shows that the OCDO share price has pulled back in the past few days. It has moved slightly below the important resistance level at 879p, where it has struggled moving below recently. It is also along the 25-day and 50-day moving averages while the Stochastic Oscillator has moved below the overbought level.

Therefore, I suspect that Ocado will continue falling as sellers target the lower side of the channel at about 760p. A move above the resistance at 879p will invalidate the bearish view.