- Summary:

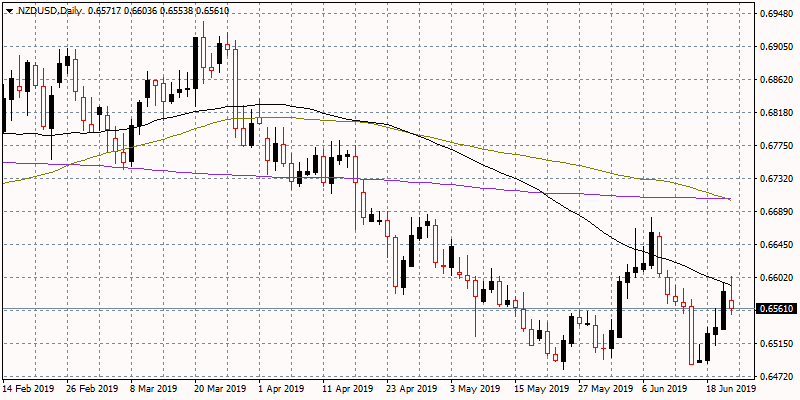

- NZDUSD started on positive foot the week with four consecutive positive sessions but today the pair found strong resistance at 0.66.

NZDUSD started on positive foot the week with four consecutive positive sessions but today the pair found strong resistance at 0.66. The pair got a hand from FED dovish comments that send the USD lower across the board. The previous week the pair retreated from two month high at 0.6675. On the other side of the equation kiwi investors have also increased bets that the Reserve Bank of New Zealand will soon announce another rate cut as a fundamental weakness in the New Zealand economy persists.

NZD dollar today gives up 0.35 percent to 0.6558. The short term momentum turned bearish as the price hovers below all the major daily moving averages. The pair rejected at 50 day moving average earlier today, scared the bulls away and drove prices below the 20 hour moving average. On the downside immediate support stands at 0.6547 the 200 day moving average, which if broken might accelerate the slide further towards 0.6537 the 100 hour moving average. On the upside first resistance stands at 0.66 today’s high while more offers will emerge at 0.67 the 100 day moving average.