- Summary:

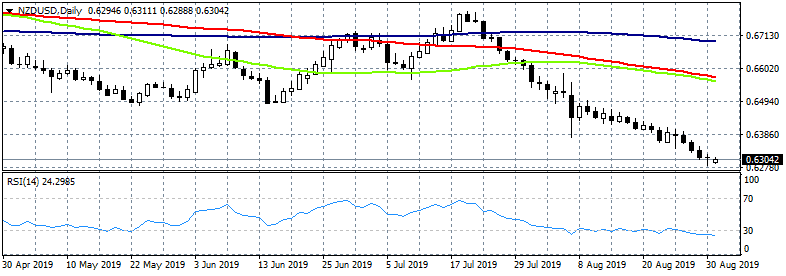

- NZDUSD momentum is bearish and, a visit down to 2015 lows looks the most possible scenario. The RSI index have reached oversold levels at 24.20

NZDUSD continues south for fifth day in a row, trading 0.05% lower at 0.6305 touching the 4-year lows at 0.6288. New Zealand Terms of Trade Index registered at 1.6% topping expectations of 1% in 2Q. RBNZ Governor Adrian Orr said that the recent interest rate cut reflected expectations of decline in trading growth, lower New Zealand inflation expectations, and a swing by central banks to lower interest rates. The cut reduces the probability of having to do more later.

NZDUSD technical analysis picture is bearish as the pair trades below all major daily and hourly moving averages; today the pair is testing the 50 hour moving average having recover above 0.63. The pair is facing two important support levels from 2015. First support stands at 0.6259 the low from August 2015 and then at 0.6235 the lows from September 2015; On the upside immediate resistance stands at 0,6346 the high from August 29th, then at 0.6402 the high from August 26th. The RSI index have reached oversold levels at 24.20 which might lead to a quick rebound above 0.64. All in all, NZDUSD momentum is bearish and, a visit down to 2015 lows looks the most possible scenario.

NZDUSD: Rebounds Above 0.63 in Asian Trading Session

NZDUSD: Rebounds Above 0.63 in Asian Trading Session