- Summary:

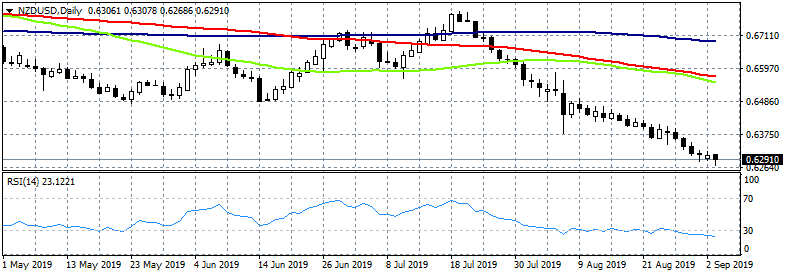

- NZDUSD breached the 0.63 mark making fresh 4-year lows as it gives up 0.23% at 0.6293 hitting the daily low at 0.6268. Grant Robertson the New Zealand

NZDUSD breached the 0.63 mark making fresh 4-year lows as it gives up 0.23% at 0.6293, hitting the daily low at 0.6268. Grant Robertson the New Zealand finance minister, noted that Government is prepared to respond to global economic shock. Yesterday, the New Zealand Terms of Trade Index registered at 1.6% topping expectations of 1% in 2Q. RBNZ Governor Adrian Orr said that the recent interest rate cut reflected expectations of decline in trading growth, lower New Zealand inflation expectations, and a swing by central banks to lower interest rates. The cut reduces the probability of having to do more later.

NZDUSD technical analysis picture is bearish as the pair trades below all major daily and hourly moving averages; today the pair slumped to 0.6268 a level that we haven’t seen since August 2015. The pair is now facing two crucial support levels from 2015. First support stands at 0.6259 the low from August 2015 and then at 0.6235 the lows from September 2015; First support for the pair is today’s low at 0.6268. On the upside immediate resistance stands 0.6318 the high from yesterday, then at 0,6346 the high from August 29th, while more offers expected at 0.6402 the high from August 26th. The RSI index has reached oversold levels at 23.18, which might lead to a quick rebound above 0.63. All in all, NZDUSD momentum is bearish and, a visit down to 2015 lows looks a possible scenario.