- Summary:

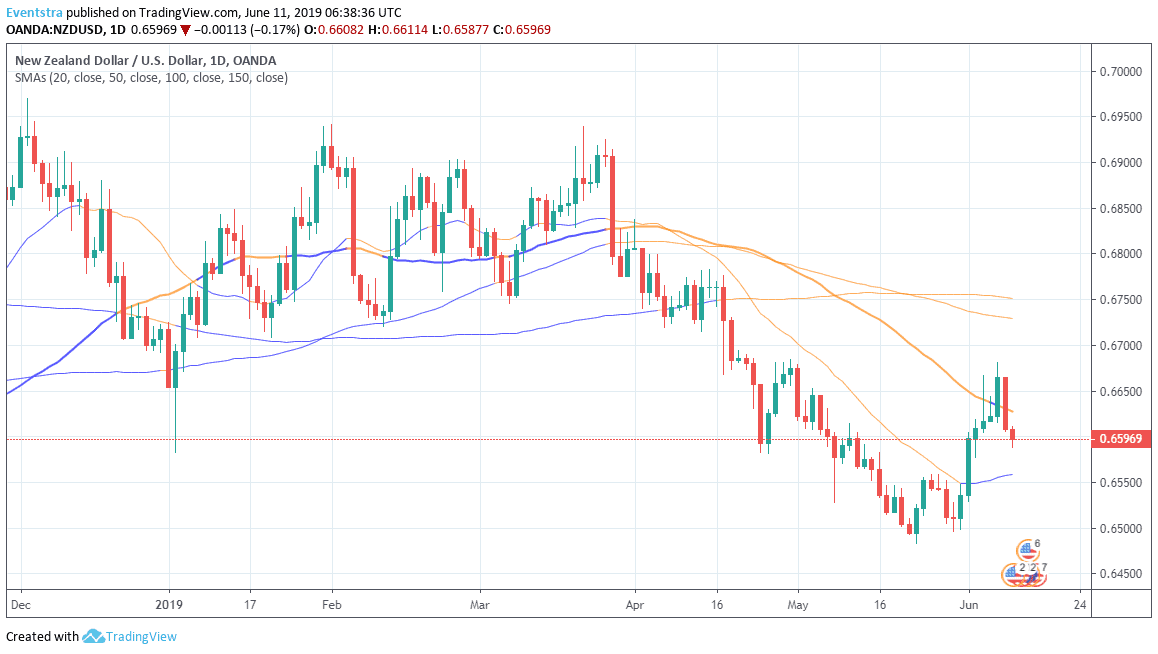

- NZDUSD is in corrective mood this week as the pair retreats from two month high at 0.6675. USD was under selling pressure the previous week as traders

NZDUSD is in corrective mood this week as the pair retreats from two month high at 0.6675. USD was under selling pressure the previous week as traders increased bets for an 85% chance of a Fed fund rate cut by August, with a total of three cuts priced by May 2020. That helped the kiwi to register 2 percent gains the previous week marking its strongest weekly gain since November. This week is a different story, the USDollar took advantage of improving risk sentiment and above estimates JOLTS jobs openings. Investors were also on the round that the Reserve Bank of New Zealand will soon announce another rate cut as a fundamental weakness in the New Zealand economy persists.

NZD dollar lost over 40 pips yesterday down to 0.66 mark. The pair breached the 100 hour moving average and that add to pressure, so today the pair broke below the 0.66 down to 0.6590. Traders must be cautious as the pair is trading below the 50 day moving average. A move below the 200 hour moving average at 0.6589 might force the prices down to 0.65. On the upside investors must be patient and enter any long positions only if the pair manages to break above the recent high at 0.6675.