- Summary:

- NZDUSD is trading 0.14 percent higher at 0.6537 boosted by better employment data. Unemployment Rate in New Zealand for the second quarter dropped to

NZDUSD is trading 0.14 percent higher at 0.6537 boosted by better employment data. Unemployment Rate in New Zealand for the second quarter dropped to 3.9% from 4.2% beating the market expectation of 4.3%. Employment increased by 0.8% in the same period following the 0.2% contraction in the previous quarter. Reserve Bank of New Zealand announced that the Q3 inflation expectations slumped to 1.86% from 2.01%. The United States Redbook Index (YoY) increased to 5.1% in August 2 from previous 4.5% while the monthly data also came up to 1.1% in August 2 from previous 1%.

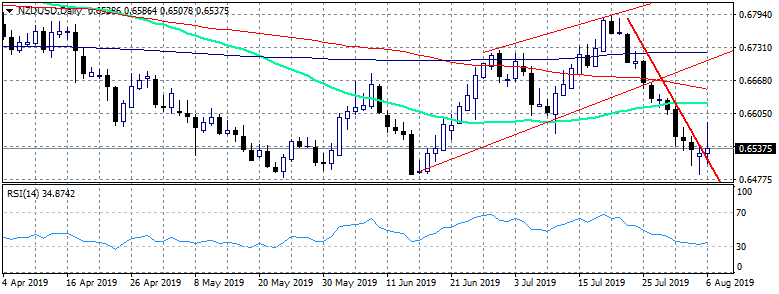

On technical side the pair is bearish and has registered eleven consecutive days of losses before returning to gains yesterday. Today the pair managed to breach above the steep descending trend line that drove the price lower reaching the daily high at 0.6586. As the US session started trading, the pair gives up gains and now looks for support first at the descending trendline around 0.6521 and then at 0.65 round figure before the strong support at 0.6489 the low from June 18th. On the upside immediate resistance stands at 0.6586 the daily high and then at 0.6624 the 50 day moving average. If the pair manages to close above it might continue with an attempt to 0.6650 the 100 day moving average and then at 0.6722 the 200 day moving average.