- Summary:

- On technical side the NZDUSD pair is bearish, and today failed to hold above the 50 hour moving average enhancing the short term negative momentum

NZDUSD is trading 0.26 percent lower at 0.6429 as the pair continues the downward move after Reserve Bank of New Zealand cut aggressively the OCR by 50bp to 1.00%, while the market forecasting a 25bp cut. The RBNZ Monetary Policy Committee expects growth to remain soft in the near term. The central bank has revised its GDP forecasts lower accordingly by -0.3 to -0.5 through the second quarter of next year.

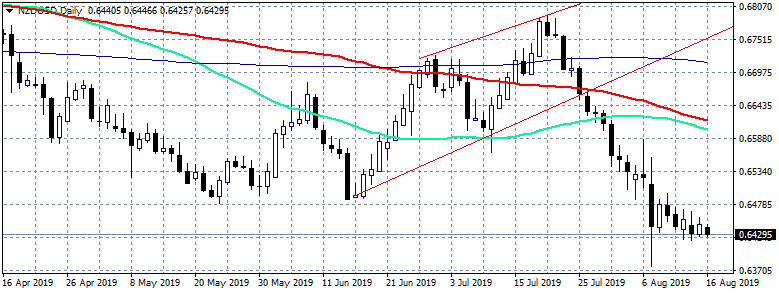

On technical side the NZDUSD is bearish, and today failed to hold above the 50 hour moving average enhancing the short term negative momentum. Now the pair’s immediate support stands at 06425 today’s low and then at 0.6346 the low from January 2016. On the upside immediate resistance stands at 0,6438 the 50 hour moving average while more offers will emerge at 0.6472 the 200 hour moving average. All in all NZDUSD is bearish and traders have to wait until the dust from the unexpected interest rate cut settles down.