- Summary:

- The NZDUSD continues pushing upwards as the upbeat CPI figure & background weakness in the US Dollar continue to drive up risky assets paired with the USD.

The NZDUSD was in focus as the Consumer Price Index report was released a short while ago. The quarterly CPI came in at 0.5%, which was better than the market consensus figure of 0.2%. Despite being less than the previous level of 0.7%, the markets applauded the figure and the pair is starting to see demand.

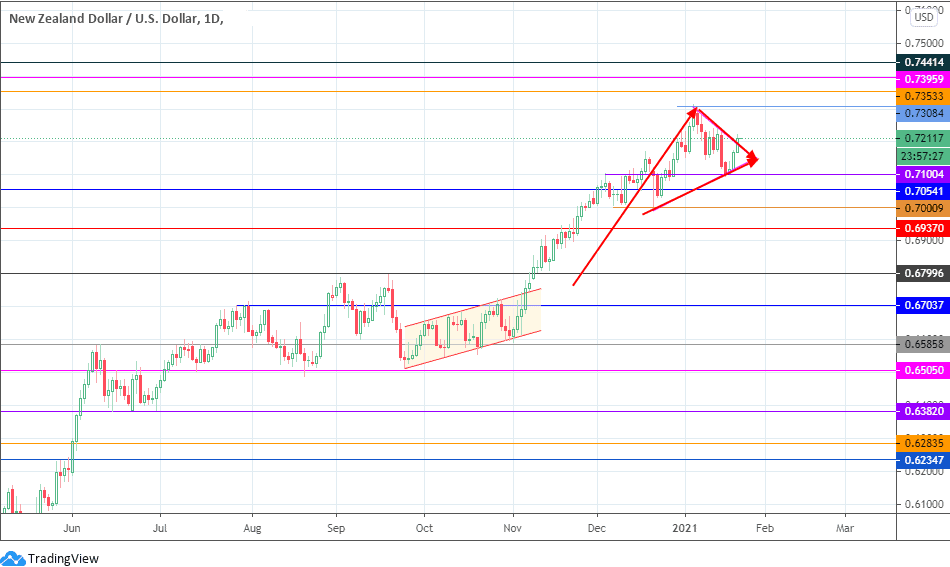

With the US Dollar firmly on the back foot, the upbeat data release allowed the NZDUSD to extend the upside move of the day. The daily candle of January 21 has also closed above the upper border of the pennant consolidation area.

Technical Outlook for Brent Crude

The NZDUSD is now primed to break out of the bullish pennant pattern. However, a successive daily candle must close above the pennant’s upper border to confirm the breakout. This puts 0.73084 in line to become the initial target for bulls. Additional targets to the north include 0.73533 (14 March 2018 high) and 0.73959 (11 April 2018 high). If the price pattern is viewed as a bullish pennant, we can expect an extension of the upside move beyond 0.74414 (15 February 2018 high), as the NZDUSD pursues the measured move.

On the other hand, a breakdown of the consolidation area brings in 0.71004, with 0.70541 and 0.7009 lurking closeby as additional targets to the south.

NZDUSD Daily Chart