- Summary:

- The NZD/USD price drifted upwards even after the relatively weak New Zealand retail sales data. The exchange rate rose to a high of 0.6227

The NZD/USD price drifted upwards even after the relatively weak New Zealand retail sales data. The exchange rate rose to a high of 0.6227 on Thursday morning, which was higher than this week’s low of 0.6160.

New Zealand retail sales and Jackson Hole

The NZD to USD exchange rate rose slightly after New Zealand published relatively weak retail sales numbers. These numbers revealed that the country’s sales dropped by 2.3% in the second quarter as inflation continued rising. This decline was worse than the median estimate of a 1.7% increase and the first quarter’s decline of 0.9%.

The volume of retail sales dropped by 3.7% in Q2 compared to the same quarter in 2021. These numbers came a few days after New Zealand published relatively weak trade data. They also came after the Reserve Bank of New Zealand (RBNZ) decided to hike interest rates in a bid to contain the soaring inflation.

The next key catalyst for the NZD/USD price will be the upcoming Jackson Hole Symposium in Wyoming and the latest US GDP data. The symposium will see Fed officials, especially Jerome Powell talk about monetary policy. This will be his first statement after the US published encouraging inflation data. There is a possibility that he will insist that higher rates were necessary to bring inflation down.

The second reading of US GDP data will likely have no major impact on the NZD/USD price since the numbers will likely be in line with the previous estimate. The estimate showed that the American economy sunk to a recession in Q2 as it contracted by 0.8%.

NZD/USD forecast

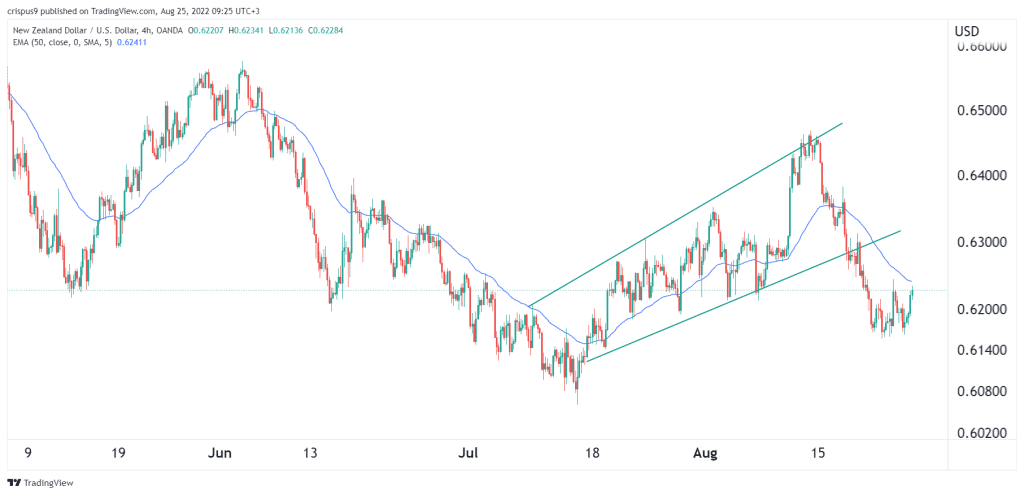

The four-hour chart shows that the NZD to USD exchange rate has been in a strong bearish trend in the past few weeks. This drop culminated in the pair falling below the lower side of the ascending channel. It has managed to move below the 50-day moving average. A closer look shows that the pair has formed a small double-bottom pattern.

Therefore, the pair will likely do a break and retest pattern and retest the lower side of the channel at about 0.6300. A drop below the support at 0.6150 will invalidate the bullish view.