- Summary:

- The NZD/USD price moved sideways on Wednesday morning as investors waited for the upcoming Fed interest rate decision.

The NZD/USD price moved sideways on Wednesday morning as investors waited for the upcoming Fed interest rate decision. The pair was trading at 0.6238, which was slightly below last week’s high of 0.6300. This price is about 2.95% above the lowest level this month.

Fed is the main game in town.

The NZD to USD exchange rate moved sideways as investors focused on the upcoming Fed decision. The Federal Open Market Committee (FOMC) will conclude its two-day meeting on Wednesday and then decide on whether to hike interest rates again.

Analysts expect the bank to deliver another 0.75% rate hike in a bid to fight the soaring inflation. However, others believe that the bank could surprise the market with a giant 1% rate hike in a bid to push the economy to a recession and control inflation.

Still, recent data show that inflation may have peaked or even paused. For example, gasoline prices have nosedived from over $5 last month to an average of $4.33. In a statement this week, Walmart said it will start offering discounts to deal with the soaring inventories.

NZD/USD forecast

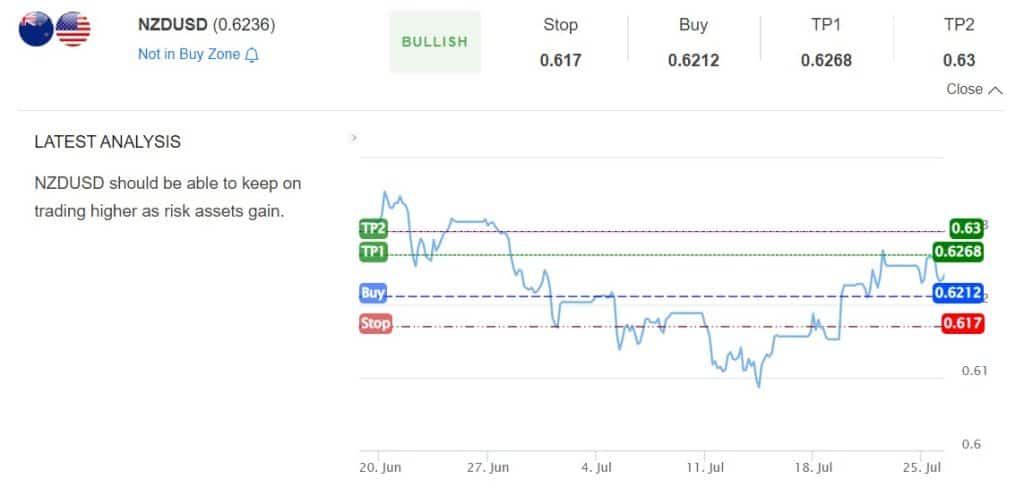

The four-hour chart shows that the NZD/USD price rose to a high of 0.6300 ahead of the Fed decision. The pair remains slightly above the important support at 0.6200, which was the lowest level on May 12 and June 15 of this year. It is also slightly above the 50-day moving average and the Ichimoku cloud.

Therefore, the outlook for the pair is currently neutral with a bullish bias. According to InvestingCube’s S&R indicator, the pair will likely continue to resume the bullish trend and retest the key point at 0.6300. However, a drop below the key support at 0.6200 will invalidate the bullish view. Subscribe to this indicator for real-time forecasts on popular assets.