- The NZD/USD price recoiled on Wednesday morning even after the extremely hawkish interest rate decision by the RBNZ.

The NZD/USD price recoiled on Wednesday morning even after the extremely hawkish interest rate decision by the RBNZ. The NZD to USD exchange rate crashed to a low of 0.6100, which was the lowest level since Tuesday. It has fallen by more than 17% from its highest point in 2021 and is hovering at the lowest point since May 2021.

RBNZ interest rate hike

The NZDUSD price declined sharply after the latest decision by the RBNZ. In a statement, the bank decided to deliver another giant rate hike. It increased the Official Cash Rate by 50 basis points as it accelerated its fight against inflation. The bank also hinted that rate hikes will continue in the coming meetings.

It expects to continue hiking interest rates in the near term considering that inflation is expected to rise above 4%. The unemployment rate has moved close to a record low. As such, they expect that there will be wage pressure as companies compete for talent in the near term. The statement added that:

“The Committee agreed to maintain its approach of briskly lifting the OCR until it is confident that monetary conditions are sufficient to constrain inflation expectations and bring consumer price inflation to within the target range.”

The NZD/USD price retreated after the RBNZ hike because it was already priced in by market participants. Also, the bank did not deliver any new news that could have impacted the kiwi. Further, the path set by the RBNZ is not as aggressive as the one set by the Federal Reserve. The Fed has hinted that it will hike interest rates by 0.75% in July.

The next key catalyst for the NZD to USD price will be the upcoming US consumer inflation data. Analysts see the country’s inflation surging to 8.8% in June of this year.

NZD/USD forecast

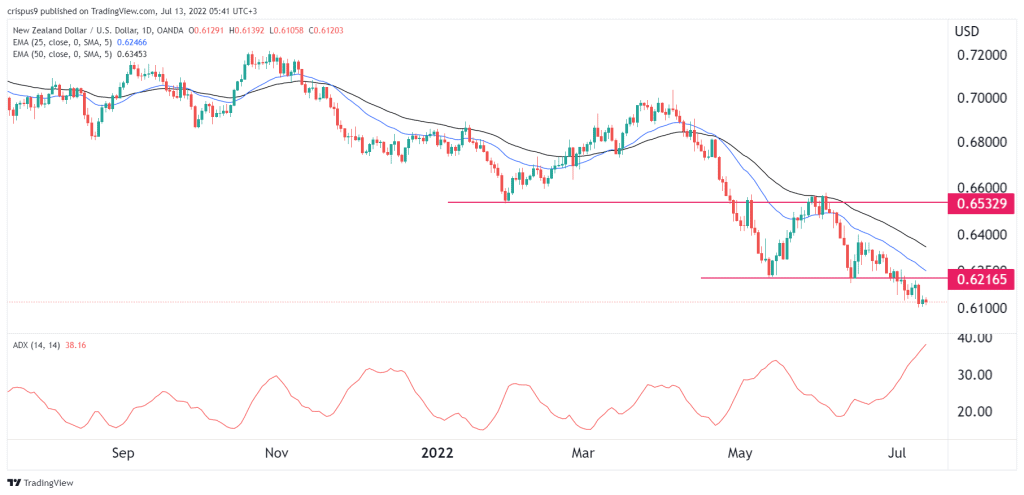

The daily chart shows that the NZD/USD price continued crashing on Wednesday after the latest RBNZ decision. It moved below the important support level at 0.6216, where it struggled to move below in May and June. The price is also below the 25-day and 50-day moving averages while the Average Directional Index (ADX) has risen to the highest point in months.

Therefore, the pair will likely continue falling as sellers target the key support at 0.600. A move above the resistance at 0.6216 will invalidate the bearish view. This view is in line with the live NZDUSD signal by InvestingCube’s S&R signal which you can subscribe here.