- The Nvidia share price action is evolving into a rounded bottom pattern, which points to a limited upside as forecast by Morgan Stanley.

This Tuesday, the Nvidia share price activity is struggling to stay afloat after Monday’s uptick. Monday’s gains were the product of a sector-wide boost by the performance of a peer company. ON Semiconductor announced better-than-expected quarterly earnings and provided robust forward guidance, which generally lifted semiconductor stocks and spurred the Nvidia share price to a 5.32% uplift.

Morgan Stanley recommends the stock as a “core holding”, but the bank’s analysts say the gaming sector’s slowdown remains a short term risk. The bank maintains a $217 price target for the stock, with an Equal Weight rating. This price target gives the stock a limited upside potential of 11.8%.

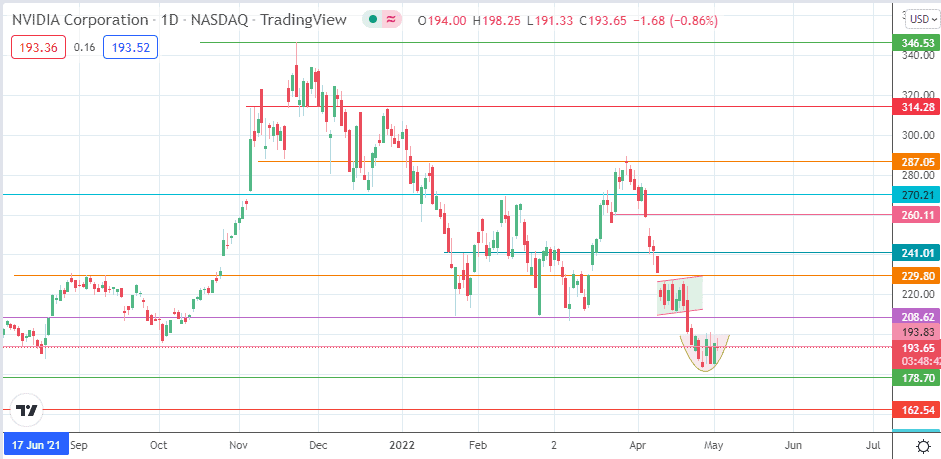

Technically speaking, the recent price action has shown signs of forming a rounding bottom. This potentially bullish reversal pattern follows the completion of the measured move from the bearish flag on the daily chart. Will this usher in a reversal in the Nvidia share price?

Nvidia Share Price Outlook

The active candle needs to close above 193.83 to preserve the sanctity of this support level. This would provide a chance for a bounce towards 208.62 (24 February and 8 March lows). An additional upside push sends the price activity towards 229.80 (25 January and 15 March 2022 highs), before 241.01 (17 March low in role reversal), and 260.11 (21 March and 5 April lows) enter the mix as additional targets to the north.

On the flip side, a decline below 193.83 sets up the potential for the Nvidia share price action to hit 178.70 (21 June and 19 July 2021 lows). A further decline targets 162.54 (15 April 2021 high and 2 June 2021 low). The 22 April 2021 low at 148.33 and the 13 May 2021 low at 134.27 form additional targets to the south if the decline is more extensive.

Nvidia: Daily Chart

Follow Eno on Twitter.