- Summary:

- The EasyJet share price is yet to recover after the company rejected a bid by rival Wizz Air two months ago

The EasyJet share price is yet to recover after the company rejected a bid by rival Wizz Air two months ago. The stock has dropped to 580p, which is the lowest level since September 17th. It has dropped by more than 37% from its year-to-date high.

Recovery stalls

EasJet and other airline companies are at crossroads. On the one hand, demand has dropped precipitously in the past few months as more countries reopen.

Today, people in Europe can travel in the region without any restrictions. The strong recovery of the region has been shown by the just concluded Dubai Air Show, where Airbus and Boeing received substantial orders.

On the other hand, airlines are facing the challenge of high oil prices. In the past few months, the price of crude oil has jumped to a multi-year high as demand rises. And there is a likelihood that this trend will continue in the coming months. As such, many airlines have warned that their margins will be under pressure. So, what next for EasyJet?

EasyJet share price forecast

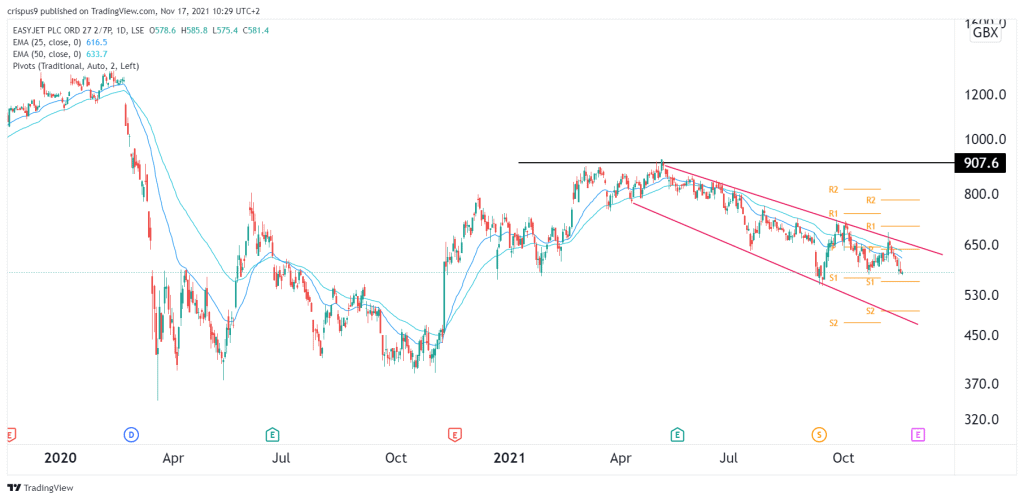

On the daily chart, we see that the EZJ share price has been in a bearish trend in the past few months. As a result, it has formed a broadening falling wedge pattern. In price action analysis, this pattern is usually a bearish sign.

The stock has also fallen below the 25-day and 50-day MAs. It is also approaching the first support of the standard pivot points. Therefore, the stock will likely keep falling as bears target the second support level at 500p. This view will become invalid if the price rises above 600p.