- Summary:

- In a week where Tesla has hit highs above the $1,000 per share mark, Chinese EV maker NIO is looking to kickstart its own price gains.

In a week where Tesla has hit highs above the $1,000 per share mark, Chinese EV maker NIO is looking to kickstart its own price gains.

However, positive developments have included a recent ratings upgrade from investment bank Goldman Sachs, and better-than-expected Q3 delivery numbers.

Goldman analyst Fei Fang says the next six months will see “strong volume expansion” with:

- Introduces the ET7 sedan in China (expected Q1 ’22 sale).

- Enters the Norwegian electric car market.

- The “Nio Day 2021” where the company will unveil a second sedan, the ET5 which could rival the Tesla Model 3.

Profits should also benefit thanks to the ET7, which Fang says is expected to be “China’s priciest car model launched by a domestic brand.”

Nio delivered 24,439 vehicles in Q3, which was higher than its forecast of 22,500 to 23,500 vehicles. Deliveries have doubled on a year-over-year basis and September saw a new all-time monthly record of more than 10,000 vehicles.

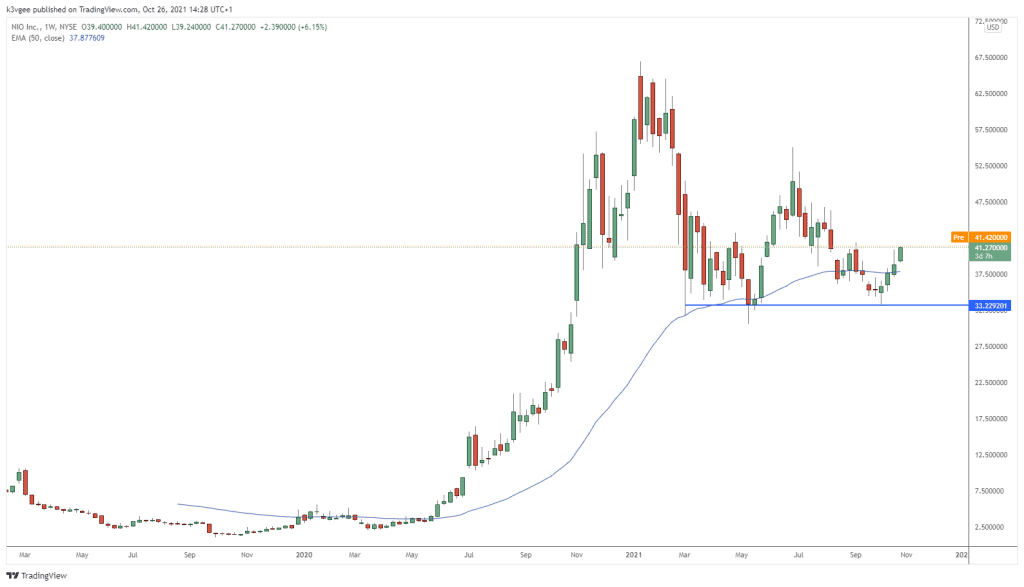

Nio Price Analysis

The price of NIO has found a good base around the $33 level and has pushed higher to the $42 level above the moving average. A third round of support is a good sign for the stock and it should look to target the resistance near $53. The all-time high in NIO is around the $66 level.

Nio Price Chart (Weekly)