- Summary:

- The Nio share price could be in for some selling if the decline in October sales is backed up by selling from the megaphone top.

Monday’s announcement by Nio on a drop in its October deliveries year-on-year by 27% is triggering has not shaken investors, as far as Tuesday’s price activity shows. The Nio share price is up 2.18% despite reporting that it delivered 3,667 vehicles in October.

The company blamed supply chain issues and upgrades to its manufacturing lines, reducing production volumes. China has been hit recently by power cuts, as electricity generation companies find it hard to stay profitable with soaring coal and natural gas prices.

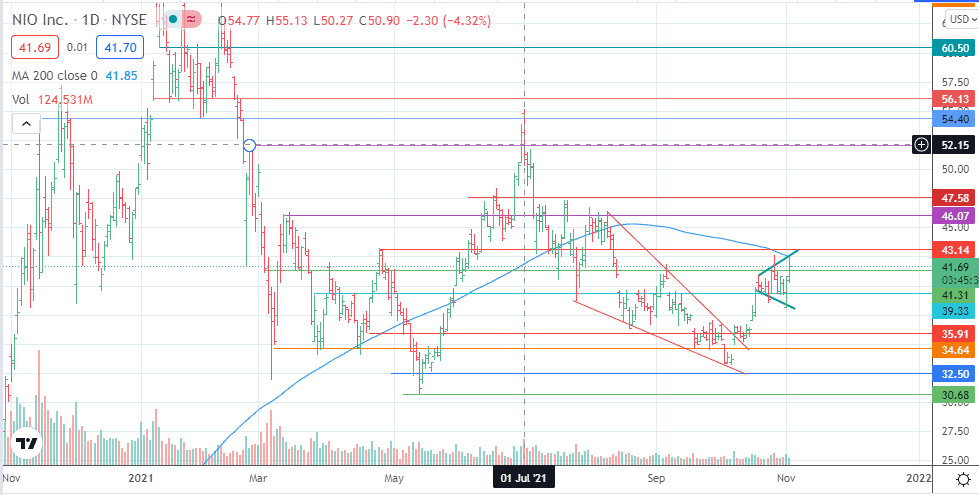

Despite the intraday gains, the price is now facing a stiff test at the 200-day moving average, with the formation of the expanding triangle/megaphone top also holding some promise for a near-term retreat.

Nio Share Price Outlook

The Nio share price activity is testing resistance at the 200-day moving average, just below the 43.14 horizontal barrier (27 April/27 July high). Only a break of these barriers will open the door to advance the bulls towards the 46.07 and potentially 47.58 resistance levels.

On the flip side, rejection at the current area opens the door for a test of 41.31, with 39.33 and 35.91 lining up as potential downside targets. Supporting this outlook is the completion of the falling wedge’s measured move at 42.61, followed by the expanding triangle on the daily chart.

Nio: Daily Chart

Follow Eno on Twitter.