- Summary:

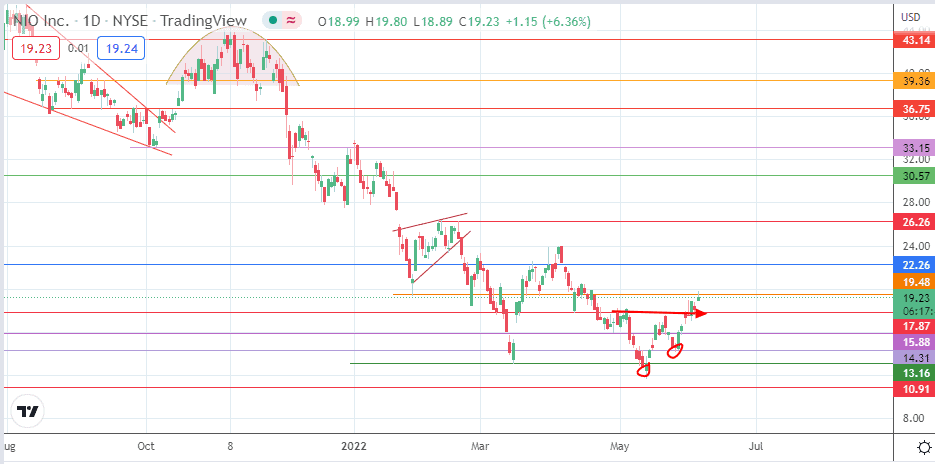

- The completion of the double bottom pattern gives the Nio share price room to advance towards the $22.26 price mark.

The Nio share price is up this Monday as the stock continues to bask in its year-on-year increase in vehicle deliveries for May. Moreover, the Chinese government’s unwinding of the excruciating lockdowns has given EV stocks a breath of fresh air. The removal of restrictions could allow Nio to unleash its potential in the year’s second half.

Despite the day’s 5.03% uptick, the advance appears to have been capped at the 19.48 immediate resistance. This is partly due to the comments made by Tesla CEO Elon Musk in a private, internal email made available by unnamed sources to Reuters. The email allegedly contained talk from Musk about downsizing 10% of Tesla’s workforce. The feelers from the email are that the EV market may be running into headwinds in the coming months.

Musk has since walked back on those comments, as worried investors continue to buy the stock cautiously, and the management at Nio appears cautiously optimistic about meeting its 2022 targets. China remains the world’s largest market for electric vehicles. The boost the Nio share price is getting after the 38% rise in vehicle deliveries may be reasons for such optimism.

Nio Share Price Outlook

The break of the 17.87 resistance, which is the neckline of the double bottom pattern, signals the completion of that pattern. The measured move is set at the 22.26 resistance mark and can only be achieved if the bulls take out the resistance at 19.48 (25 March low and 20 April high).

if the advance extends beyond this point, 26.26 (17 February 2022 high) becomes the additional northbound target. There is the potential for the psychological resistance at 24.00 (30 March/5 April high) to serve as a potential pitstop before 26.26.

On the flip side, failure to breach the 19.48 resistance truncates the breakout move. This could result in a correction that tests the 17.87 former resistance, now acting as a support level in role reversal. A further decline brings in 15.88 (28 April/27 May lows) to the mix, leaving 14.31 (26 May low) and 13.16 (15 March low) as additional targets to the south.

Nio: Daily Chart