- Summary:

- Asian indices and Nikkei finished lower as investors worries about China-US trade relations resurface and following the release of disappointing

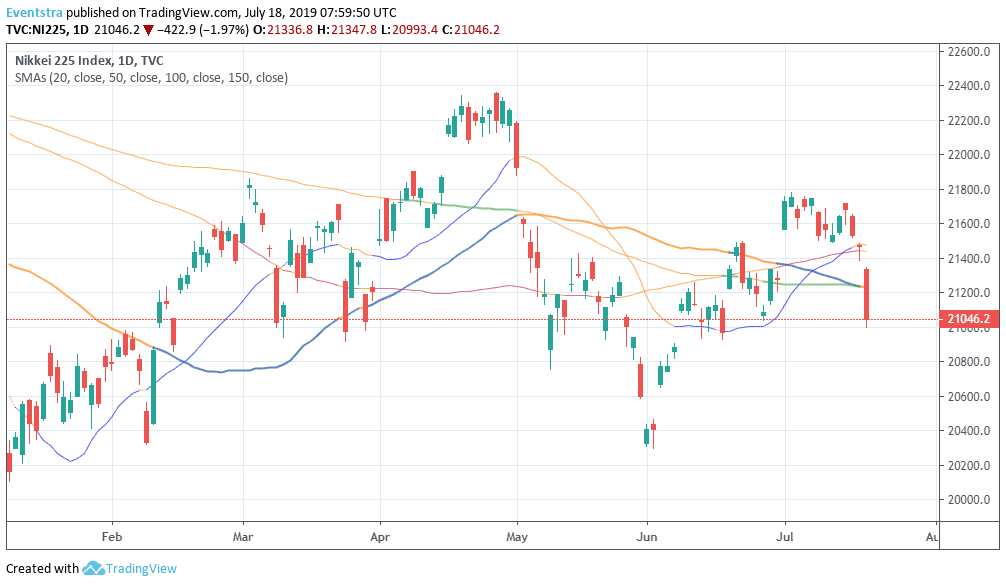

Asian indices and Nikkei finished lower as investors worry about China-US trade tensions resurface and following the release of disappointing results from Netflix (NFLX). The Hang Seng finished 0.63 percent lower at 28,408, the Shanghai composite ended 1.04 percent lower to 2,901 and the Singapore Straits Times index finished 0.44 percent lower at 3,349. Aussie stocks ended 0.40 percent lower at 6649 after the Aussie jobless rate remained steady at 5.2% as expected; but only 500 jobs were created over the month, missing expectations for an increase of about 9,000. In Japan the main benchmark, Nikkei 225 was the big looser as it finished 1.97 percent lower at 21,046. Japanese exports fell for the seventh straight month in June, as shipments of chip-making tools to China dropped sharply while the Merchandise Trade Balance Total came in at ¥589.5B beating expectations of ¥420B in June. Yesterday the Fitch Ratings agency affirmed Japan’s Long-Term Foreign Currency Issuer Default Rating at ‘A’ with a stable outlook. The move today by the Nikkei has canceled the positive momentum and further selling pressure can’t be ruled out.

In Asian forex markets USDJPY trading 0.18 percent lower at 107.75, the Aussie dollar trades 0.34% higher against greenback at 0.7033 while Kiwi trades higher at 0.6740 versus USD. Gold holds yesterday’s gains at 1, while crude oil is 0.09 percent higher at $56.63 per barrel.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.