- Summary:

- Nikkei 225 ended almost unchanged while Asian indices finished lower today after the Fed cut interest rates by 25 bp as expected and poor progress made in

Nikkei 225 ended almost unchanged while Asian indices finished lower today after the Fed cut interest rates by 25 bp as expected and poor progress made in US-China trade talks in Shanghai. The Hang Seng finished 0.90 percent lower at 27,527, the Shanghai composite ended 0,82 percent lower to 2,908 and the Singapore Straits Times index finished 0.43 percent lower at 3,287. Aussie stocks also finished lower, ASX added 0.35% at 6,788; Australia Commonwealth Bank Manufacturing PMI came in at 51.6 topping forecasts of 51.4 in July the AiG Performance of Mfg Index rose from previous 49.4 to 51.3 in July. The Australia Import Price Index (QoQ) came in at 0.9%, above expectations (-1.4%) in 2Q, while Export Price Index (QoQ) registered at 3.8% above expectations (0.1%) in 2Q. The China Caixin Manufacturing PMI came in at 49.9, topping expectations of 49.6 in July

Nikkei 225 finished 0.09% lower at 21,540 as Japan Nikkei Manufacturing PMI came in at 49.4 below expectations of 49.6 in July. BOJ earlier this week left its interest rate policy unchanged, as widely expected, and maintained its guidance of extremely low rates at least through spring next year. The Bank of Japan added it would ease “without hesitation” if the economy growth loses momentum for achieving the BOJ’s 2% inflation target. Japanese government lowered the FY 2019 real GDP growth estimate from 1.3% to 0.9%.

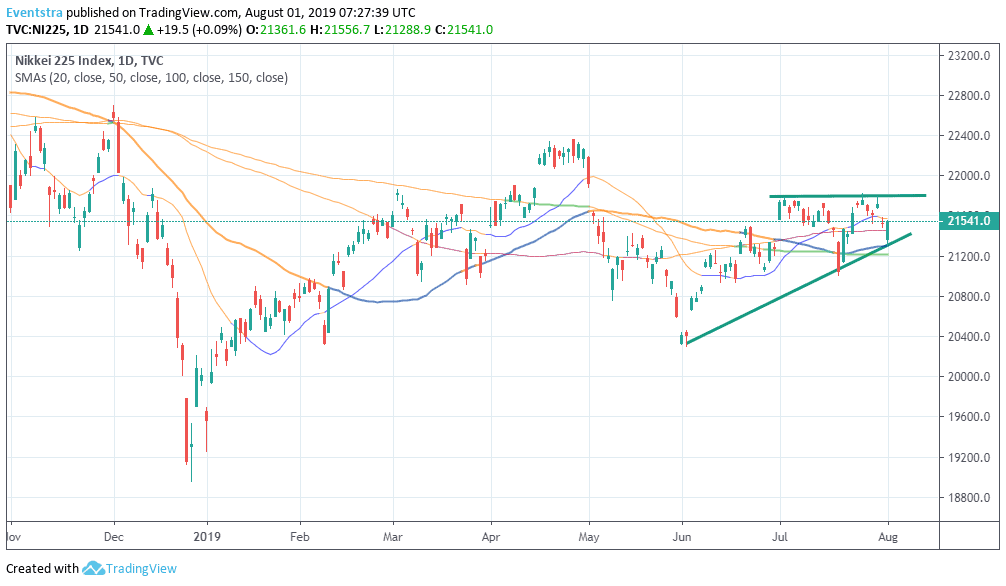

The positive momentum for Nikkei 225 is still intact as the index holds above all the major daily averages. Today it tested the 50 day moving average at 21,301 and managed to rebound regaining and the 100 day moving average. First support for the index stands at 21,451 the 100 day moving average, while another barrier is at 21,301 the 50 day moving average. On the upside resistance stands at 21,763 the high from July 30, and then at 21,807 the high from July 25th.

In Asian forex markets USDJPY trading 0.53 percent higher at 109.17, the Aussie dollar trades 0,01% higher against greenback at 0.6845, while Kiwi also trades lower at 0.6555 versus USD. Gold is trading lower at 1,407, while crude oil is 1.23 percent lower at $57.86 per barrel.Don’t miss a beat! Follow us on Twitter.