- Summary:

- Nikkei 225 finished 2.17% higher at 20,261 after Japan Leading Economic Index came in at 100.4 beating forecasts of 93.3 in June. Japan June final

Asian equities and Nikkei 225 finished sharply lower today as investors dump risky assets amid trade war escalation between US and China. The Hang Seng trading 2.55 per cent lower at 25,511, the Singapore Straits Times index finished 1.34 per cent lower at 3,068 and the Shanghai composite ended 1,17 per cent lower to 2,863. Aussie stocks finished lower, the ASX ended 1.27% lower at 6,440.

Nikkei 225 finished 2.17% higher at 20,261 after Japan Leading Economic Index came in at 100.4 beating forecasts of 93.3 in June. Japan June final leading indicator index came in at 93.3 as per expectations.

Nikkei 225 getting a boost from Comsys +1.19%, Maruha +0.96% and FamilyMart +0.58%. On the other hand Taiyo Yuden Co. Ltd. -6.52%, Yaskawa -5.64% and Yokogawa -5.53%.

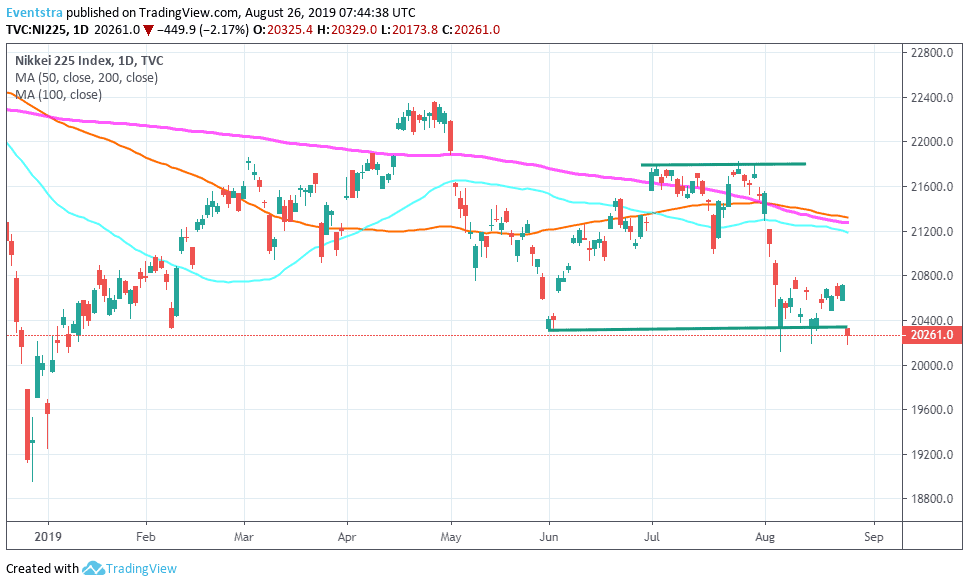

The index started sharply lower today canceling the recent positive momentum that has build after it managed to rebound from seven month lows. The index closed below the strong support line at 20,327. On the downside immediate support stands at 20,173 today’s low and then at 20, 121 the low from August 6th. A break below that level might accelerate the selloff below the 20,000 mark. On the upside resistance for the Nikkei 225 stands at 20,329 today’s high and then at 21,192 the 50 day moving average.

In Asian forex markets USDJPY trading 0.38% higher at 105.76 after the pair hit 3 year lows, the Aussie dollar trades 0,09% higher against greenback at 0.6753, while Kiwi trades 0.34% lower at 0.6372 versus USD. Gold trades higher at 1,531, while crude oil is 1.04% lower at $55.61 per barrel.