- Summary:

- The Nikkei 225 continues north for tenth consecutive trading session, making higher highs and higher lows, as the recent bullish wave now targets the yearly

Nikkei 225 and Asian markets ended higher today amid as investors cheer the stimulus unleashed by central banks around the world. The Hang Seng trading 0.12 per cent lower at 26,435, the Singapore Straits Times index finished 0.17 per cent higher at 3,165, and the Shanghai composite ended 0,24 per cent higher at 3,006. Aussie stocks finished higher; the ASX 200 ended 0.20% higher at 6,730. In India an unexpected corporate tax cut boosts Nifty 50 to 7-week highs.

Nikkei 225 finished 0.16% higher at 22,079 as USA and China resumed negotiations in Washington. The Japan National Consumer Price Index (year over year) registered at 0.3%, below forecasts of 0.6% in August.

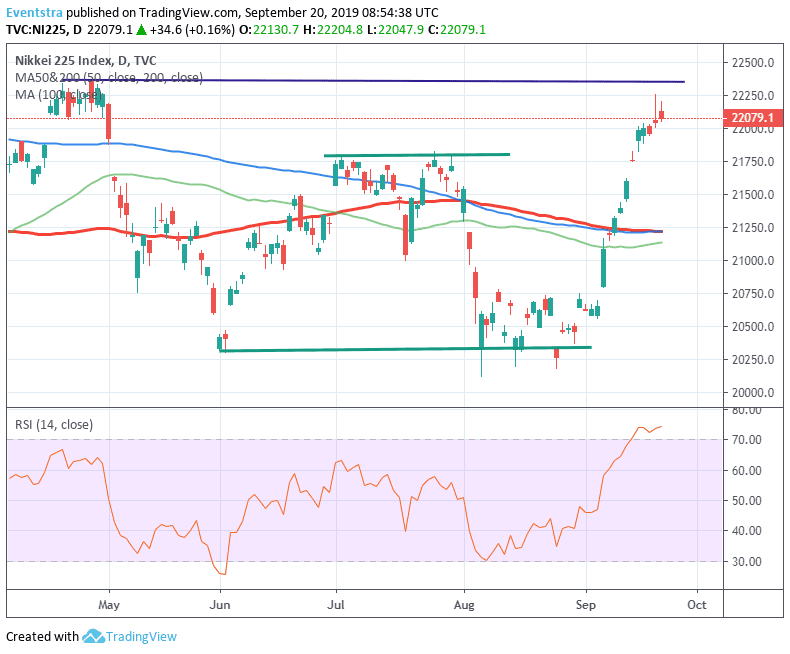

The Nikkei continues north for tenth consecutive trading session, making higher highs and higher lows, as the recent bullish wave now targets the yearly highs. On the upside resistance for the Nikkei 225 stands at 22,204 today’s high, a break above, perhaps will set the stage for a move up to yearly highs. The index have reached overbought levels as indicated by the RSI index so a correction can’t be ruled out. On the downside immediate support stands at 22,047, today’s low and then at 21,219 the 100-day moving average. A break below that level might accelerate the selloff down to 21,138 and the 200-day moving average.

In Asian forex markets USDJPY trading 0.08% lower at 107.92, the Aussie dollar trades 0,03% higher at 0.6793, while Kiwi trades 0.32% lower at 0.6280 versus USD. Gold trades higher today at 1,504, while crude oil is 0.40% higher at $58.42 per barrel.