- Summary:

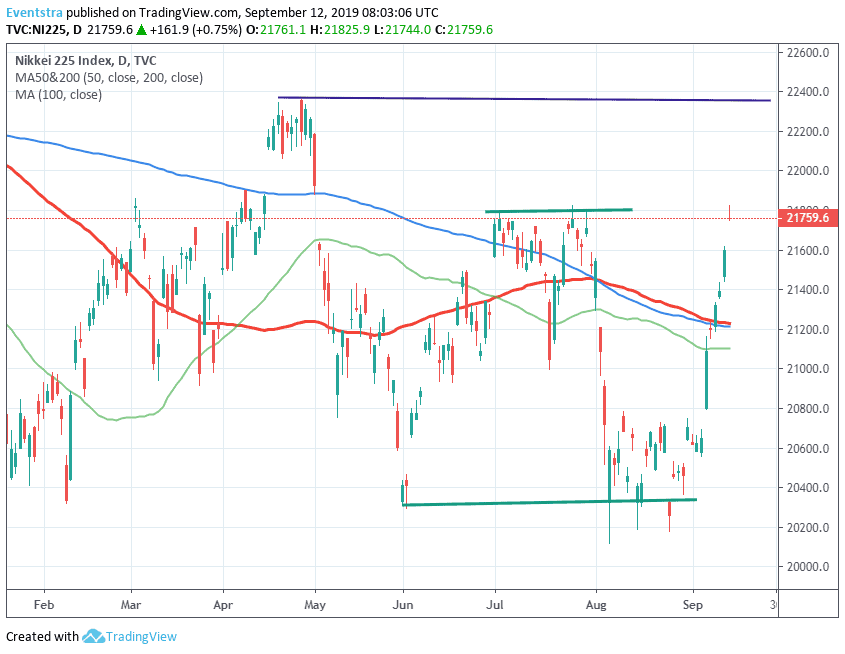

- On the upside resistance for the Nikkei 225 stands at 21,825 today’s high, a break above, perhaps will set the stage for a move up to 22,180

Asian markets are trading mixed today on renewed optimism after President Trump announced a 2-week delay in tariff hikes in $250 billion in Chinese imports while investors await the ECB decision on Thursday. The Hang Seng trading 0.04 per cent lower at 27,149, the Singapore Straits Times index finished 0.12 per cent lower at 3,200, and the Shanghai composite ended 0,75 per cent higher at 3,031. Aussie stocks finished higher; the ASX 200 ended 0.25% higher at 6,654.

Nikkei 225 finished 0.75% higher at 21,759 getting a boost from Japan Machinery Orders (YoY) which came in at 0.3% topping forecasts of -4.5% in July and Japan Tertiary Industry Index (month over month) came up to 0.1% in July from previous -0.1%. Japan Foreign Investment in Japan Stocks came down to ¥-161.3B in September 6 from the previous ¥-89.5B.

The Nikkei continues north for eighth consecutive trading session enhancing the recent bullish momentum and reaching the upside target for the index that we mentioned in our Nikkei technical analysis article yestarday. On the upside resistance for the Nikkei 225 stands at 21,825 today’s high, a break above, perhaps will set the stage for a move up to 22,180 the high from May 7th. On the downside immediate support stands at 21,744, today’s low and then at 21,229 the 100-day moving average. A break below that level might accelerate the selloff down to 21,101 and the 200-day moving average.

In Asian forex markets USDJPY trading 0.10% higher at 107.90, the Aussie dollar trades 0,32% higher at 0.6884, while Kiwi trades 0.46% higher at 0.6441 versus USD. Gold trades higher today at 1,502, while crude oil is 0.47% higher at $56.01 per barrel.