- Summary:

- The Nikkei 225 index tilted higher on Friday as investors reflected on the Omicron variant and the latest Japan’s inflation data.

The Nikkei 225 index tilted higher on Friday as investors reflected on the Omicron variant and the latest Japan’s inflation data. The index rose to ¥28,820, which was significantly higher than this week’s low of ¥27,915.

Japan stocks rose after the country’s statistics agency published weak inflation data. Consumer prices were barely moved in November even as the cost of doing business rose. The core CPI, which excludes the volatile food and energy prices, rose by just 0.2% in November. The numbers came a week after the Bank of Japan (BOJ) hinted that it will halt its bond purchases program.

The Nikkei 225 index also rose after the country’s cabinet approved a record budget by Fumio Kishida. The country plans to spend $940 billion yen for the year ending in March 2023. That will be a 0.9% increase from the current year’s budget.

Still, analysts expect that the final figure will be higher because Japan is fond of extra budgets. Most of these funds will go to social spending and the promotion of science and technology.

The biggest movers in the Nikkei 225 were Fujikura, Hitachi Zosen, Dainippon Screen, and Hitachi. On the other hand, the top laggards in the index were Kawasaki Kisen, Sompo Holdings, and Mitsubishi Electric.

Nikkei 225 index forecast

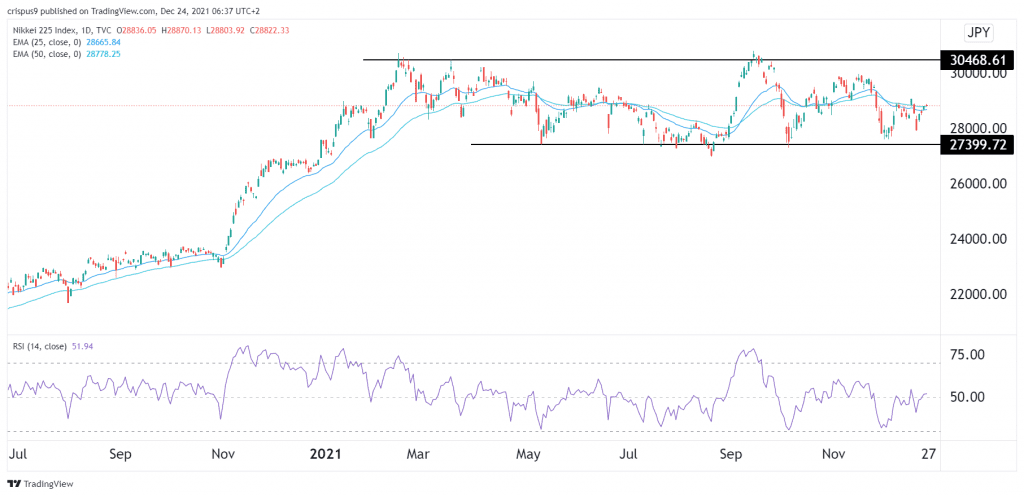

The daily chart shows that the Nikkei index has been in a tight range in the past few months. The index has remained slightly above the key support at ¥27,400 and below the resistance at ¥30,468. It is at the same level as the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved to the neutral level of 50.

Therefore, the Nikkei 225 index will likely remain in this range for the rest of the year. A drop below the support at ¥27,400 cannot be ruled out in January.