- Summary:

- The Nikkei 225 index rose to a high of ¥28,033, which was the highest level since June 10th of this year. What next for these Japan stocks?

The Nikkei 225 index rose to a high of ¥28,033, which was the highest level since June 10th of this year. NI225 has jumped by about 9.22% from the lowest level in June of this year. However, it is also about 10% below the highest level in 2021. The index has mirrored the performance of other popular indices like the Dow Jones, Russell 2000, and DAX index.

Japan stocks rebound

The Nikkei index has been in a strong bullish trend in the past few days in the past few weeks as investors focus on the performance of the Japanese yen. The USD/JPY price has fallen by more than 4.12% from its highest level this year. It was trading at 133.76 against the US dollar.

The strong recovery of the Nikkei 225 index happened as investors focused on the ongoing earnings season. The season has been relatively weak in the past few weeks. Banks like JP Morgan, Morgan Stanley, and consumer staples like Unilever and Procter & Gamble had a weak quarter as the cost of doing business.

However, analysts believe the worst is now behind it for corporations since the weak earnings were already priced in. Japanese companies like Nintendo, Itochu, and Z Holdings published weak results. The next key catalyst for the Nikkei 225 index will be earnings by key Japanese companies like Square Enix, Nikon, and Yamada, among others.

The best-performing stocks in the Nikkei index were firms like Subaru, Casio Computer, CyberAgent, Sumitomo Electric, and Daiichi Sanyo, among others. All these shares rose by more than 5%. On the other hand, Z Holdings shares crashed by more than 10% after the firm published weak results. The company owns leading brands like Yahoo Japan, Line, and PayDay. SoftBank partially owns it.

Nikkei 225 forecast

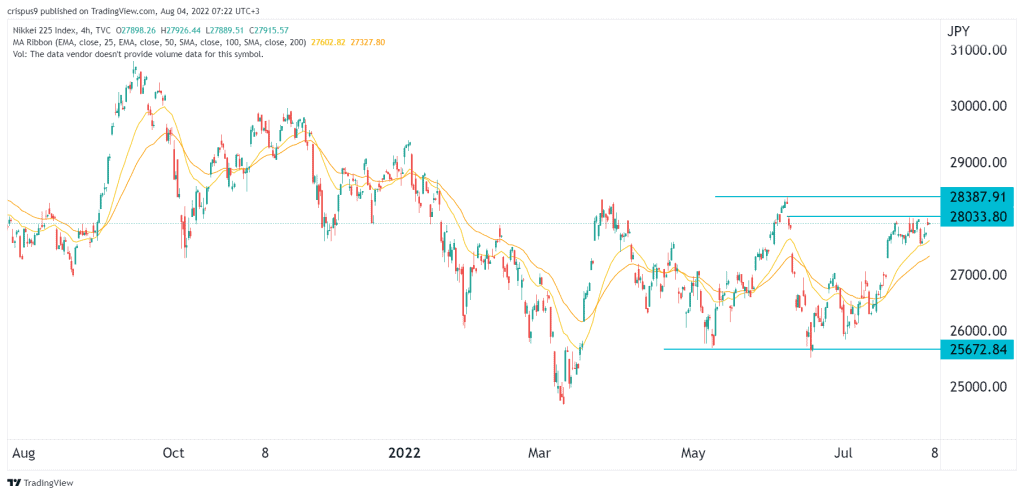

The four-hour chart shows that the Nikkei 225 index has been in a strong bullish trend in the past few days. During this time, it has risen from a low of ¥25,670, which was the lowest point on June 20th to the current ¥28,000. In addition, it has managed to move above the important 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has continued rising.

Therefore, the Nikkei 225 index will likely continue rising as bulls target the key resistance level at ¥29,000. This view will be validated if it manages to move above the resistance level at ¥28,387. On the other hand, a drop below the support at ¥27,500 will invalidate the bullish outlook.