- Summary:

- The Nikkei 225 index pulled back slightly on Wednesday after the strong Japan retail sales data. What is the outlook of Nikkei index?

The Nikkei 225 index pulled back slightly on Wednesday after the strong Japan retail sales data. It also rose after the Japanese yen continued retreating against the US dollar as the divergence between the Fed and BoJ widened. The index is trading at 28,000, which was slightly above this week’s low of 27,771.

Japan retail sales

The Nikkei 225 index is made up of the most prestigious publicly traded companies in Japan like Toyota, Recruit Holdings, Softbank, Keyence, and Sony. The index has been retreating recently in line with the performance of other global indices like the DAX, CAC 40, and FTSE 100. This decline continued after the hawkish statement by Fed’s Jerome Powell.

The Nikkei index rose slightly after the latest Japan industrial production and retail sales data. According to the statistics agency, Japan’s retail sales jumped from 1.5% in June to 2.45 in July. This increase was better than the median estimate of 1.9%. Retail sales rose even as Japan’s inflation remained at its highest level in years.

The large retailers’ index rose from -1.3% to 0.8%. Additional data showed that the industrial production forecast for one month rose from 3.8% to 5.5%. These numbers mean that the Japanese economy is doing relatively well even as key challenges remain.

The Nikkei 225 index also rose because of the weak Japanese yen. The USD/JPY exchange rate soared to a high of 139.02, which was the highest level since July this year. It has jumped by more than 6% from the lowest point in August and there is a likelihood it will continue rising. Besides, the BoJ and the Federal Reserve are on a different path in terms of monetary policy.

Nikkei 225 forecast

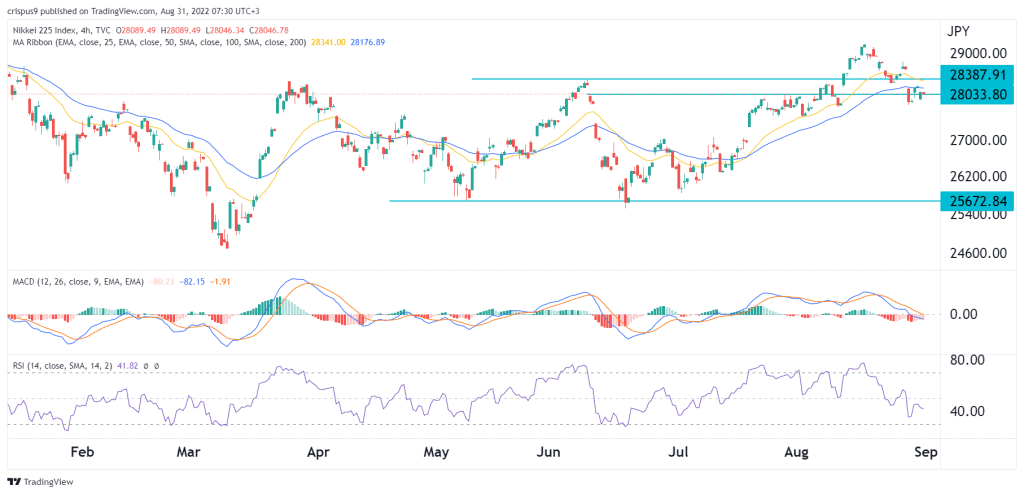

The four-hour chart shows that the Nikkei index has been retreating in the past few days. In this period, it dropped from a high of 29,220 in August to a low of 27,780. As it dropped, it moved below the important support at 28,387, which was the highest point on June 10. It also moved below the 25-day and 50-day moving averages while the MACD has moved below the neutral point.

Therefore, the index will likely continue falling as sellers target the next key support level at 27,500. A move above the resistance at 28,100 will invalidate the bearish view.