- Summary:

- Asian indices and Nikkei 225 finished higher mirroring Wall Street as stock investors sentiment improves after news that U.S. trade negotiators will likely

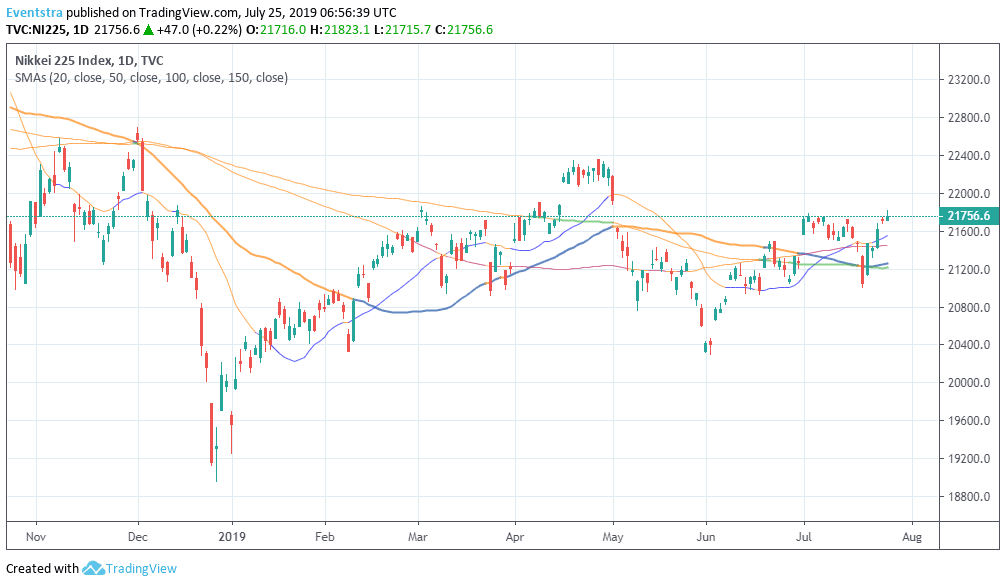

Asian indices and Nikkei 225 finished higher mirroring Wall Street as stock investors sentiment improves after news that U.S. trade negotiators will likely visit China next week for their first face-to-face talk with Chinese officials since the G20 meeting. Traders’ attention focused on ECB decision today and on the Fed policy meeting next week, as hopes of a 50 basis point cut to interest rates fade away. The Hang Seng finished 0.29 percent higher at 28,608, the Shanghai composite ended 0.18 percent higher to 2,928 and the Singapore Straits Times index finished 0.29 percent higher at 3,378. Aussie stocks trading higher with the All Ordinaries index making fresh all time high. The Reserve Bank of Australia Governor Lowe in a speech said that it’s reasonable’ to expect lower rates for longer time and RBA is prepared to ease policy further if needed, the Global disputes on trade, technology making businesses reluctant to invest. Nikkei 225 finished with gains 0.22% at 21,756 registering the fifth consecutive positive day. The positive momentum for Nikkei 225 is still intact as the index holds above all the major daily averages.

In Asian forex markets USDJPY trading 0.07 percent lower at 108.10, the Aussie dollar trades 0.09% lower against greenback at 0.6969 while Kiwi trades lower at 0.6698 versus USD. Gold is adding 3 dollars at 1,423, while crude oil is 0.35 percent higher at $56.07 per barrel.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.