- Summary:

- Nikkei 225 index slipped after the hawkish tone by Jerome Powell. We explain whether to buy or sell Japan stocks.

Japan stocks tumbled on Friday morning as investors reflected on the hawkish statement by the Federal Reserve chair. It also retreated as the Q1 earnings season took shape. As a result, the Nikkei 225 index slipped to ¥26,916, the lowest level since Monday this week. Other global indices like the Hang Seng, Dow Jones, and DAX index also retreated.

Hawkish Jerome Powell

Japan and global equities declined sharply after the latest statement by Jerome Powell. Speaking in a panel organised by the IMF, Powell reiterated that the American economy was doing well. He, however, noted that the bank was facing the challenge of high inflation. As a result, he said that there was a possibility that the Fed will likely deliver a 0.50% rate hike in its meeting in May. It will also start implementing its quantitative tightening policy.

The Nikkei 225 index is also reacting to the ongoing earnings season. Most American companies that have published their results so far have expressed the challenge of the high cost of doing business. The same situation is expected to happen in Japan. Besides, most Nikkei index constituents are industrial companies that rely on materials in their production.

The index also retreated after the latest Japan inflation data. The numbers revealed that Japan’s national inflation rose to 1.2%, while core CPI is at 0.8%. Therefore, domestic Japanese firms will likely see thinner margins considering that producer inflation has risen sharply.

Nikkei best and worst performers

On Friday, the worst performers in the Nikkei were Sumitomo Metal Mining, Pacific Metals, Fujikura, Kawasaki Kisen Kaisha, and Nissan Chemical Industry. In addition, well-known Japan stocks like Recruit Holdings, Seiko Epson, Rakuten, Sony, Softbank, and Fast Retailing also declined sharply. Conversely, the top gainers in the index were T&D Holdings, Shionogi, Mitsubishi Heavy, ANA, Sumitomo, and Marubeni.

Nikkei 225 forecast

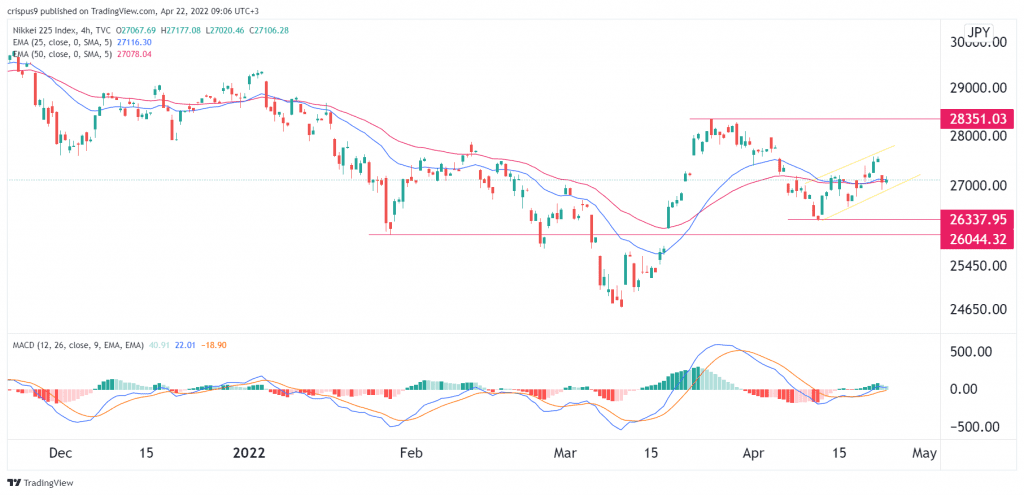

The four-hour chart shows that the Nikkei 225 index has been in a steady uptrend since April. As a result, the index formed an ascending channel shown in yellow. It is also stuck at the 25-day and 50-day moving averages, while the MACD has moved slightly below the neutral level. This price is also above the important support level at ¥26,000, the lowest in January.

Therefore, the index will likely have a bearish breakout as bears target the key support level at ¥26,337, the lowest level on April 12th.