- Summary:

- The Nikkei 225 index slipped for the second straight day even after the country’s government announced a major stimulus package.

The Nikkei 225 index slipped for the second straight day even after the country’s government announced a major stimulus package. The index dropped to a low of ¥29,437, which is about 4.5% below the highest level this year.

Japan stimulus package

The Japanese economy is struggling even as other developed countries bounce back. Earlier this month, numbers by the Ministry of Finance showed that the country’s economy slipped in the third quarter. And on Wednesday, data showed that the country’s exports and imports rose at a slower pace than expected.

Therefore, the newly elected Japanese government announced that it will spend billions of dollars in a new stimulus package. In it, the government expects to spend $350 billion. These funds will go straight to households. It hopes that these funds will stimulate the economy by boosting consumer spending.

However, the Nikkei 225 index declined because investors are not convinced about the economic recovery. For one, analysts believe that more than 70% of all funds that were distributed in the past stimulus package moved to savings accounts. The same will likely happen with this stimulus package.

Some of the best performers in the Nikkei 225 index are CyberAgent, Pacific Metals, Rakuten, and Sumitomo Electric. On the other hand, the worst performers in the index are Eisai, Impex, and Seven & I among others.

Nikkei 225 index forecast

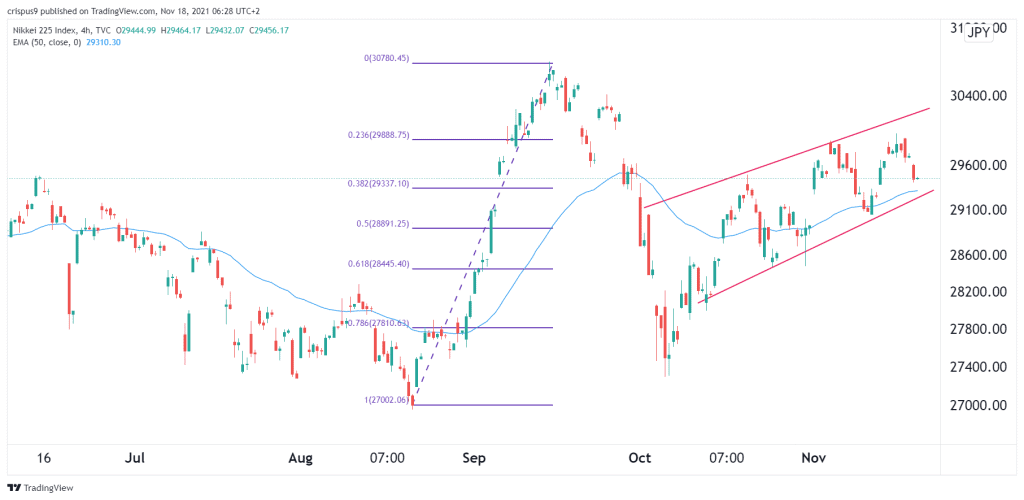

On the 4H chart, we see that the Nikkei 225 index has been under intense pressure in the past few weeks. The index has also formed an ascending channel that is shown in red. It is currently eying the lower side of this channel. Also, it is slightly above the 38.2% Fibonacci retracement level.

Therefore, the index will likely maintain a bearish trend for now. This will likely see it drop to the support at ¥29,000. On the flip side, a move above the key resistance level at ¥29,750 will invalidate this view.