- Summary:

- Asian indices and Nikkei 225 finished lower today mirroring Wall Street ater a bunch of disappointments from US companies earnings report; U.S. trade

Asian indices and Nikkei 225 finished lower today mirroring Wall Street after several disappointments from US companies earnings report; U.S. trade negotiators will likely visit China next week for their first face-to-face talk with Chinese officials since the G20 meeting. Traders’ attention turns to US Q2 GDP data and Personal Consumption Expenditures Prices for a clue about the next FED interest rates move. The Hang Seng finished 0.77 percent lower at 28,376, the Shanghai composite ended 0,24 percent higher to 2,944 and the Singapore Straits Times index finished 0.82 percent lower at 3,352 after the Singapore Industrial Production (MoM) came in at 1.2% beating expectations of -0.7% in June. Singapore Industrial Production (YoY) came in at -6.9% also beating forecasts -7.9% in June.

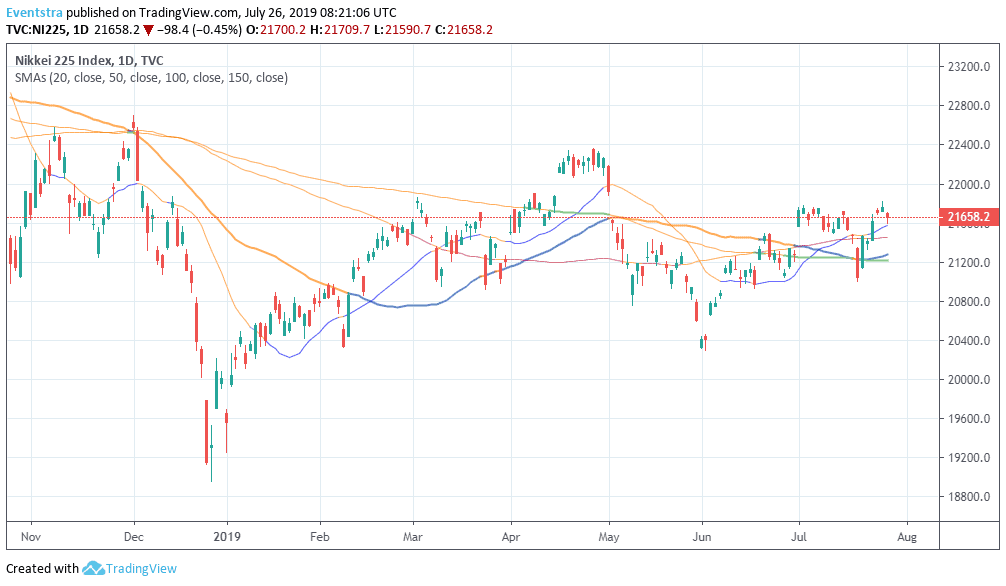

Aussie stocks finished 0.36% lower at 6793.4. Nikkei 225 finished 0.45% lower at 21,658 as trade tensions between South Korea and Japan escalates after the reports that Japan will remove South Korea from its list of most-favored trading partners. The positive momentum for Nikkei 225 is still intact as the index holds above all the major daily averages. First support for the index stands at 21,574 the 20 day moving average, while another barrier is at 21,275 the 50 day moving average.

In Asian forex markets USDJPY trading 0.47 percent higher at 108.64, the Aussie dollar trades 0,29% lower against greenback at 0.6930 while Kiwi also trades lower at 0.6647 versus USD. Gold is adding 2 dollars at 1,417, while crude oil is 0.20 percent higher at $56.13 per barrel.Don’t miss a beat! Follow us on Twitter.