- Summary:

- Asian indices and Nikkei 225 finished lower today ahead of the Fed interest rates decision on Wednesday and U.S. trade negotiators will visit China for

Asian indices and Nikkei 225 finished lower today ahead of the Fed interest rates decision on Wednesday and U.S. trade negotiators will visit China for their first face-to-face talk with Chinese officials since the G20 meeting. The Hang Seng finished 1.01 percent lower at 28,111, the Shanghai composite ended 0,12 percent lower to 2,941 and the Singapore Straits Times index finished 0.71 percent lower at 3,339 Aussie stocks finished 0,48% higher at 6825.

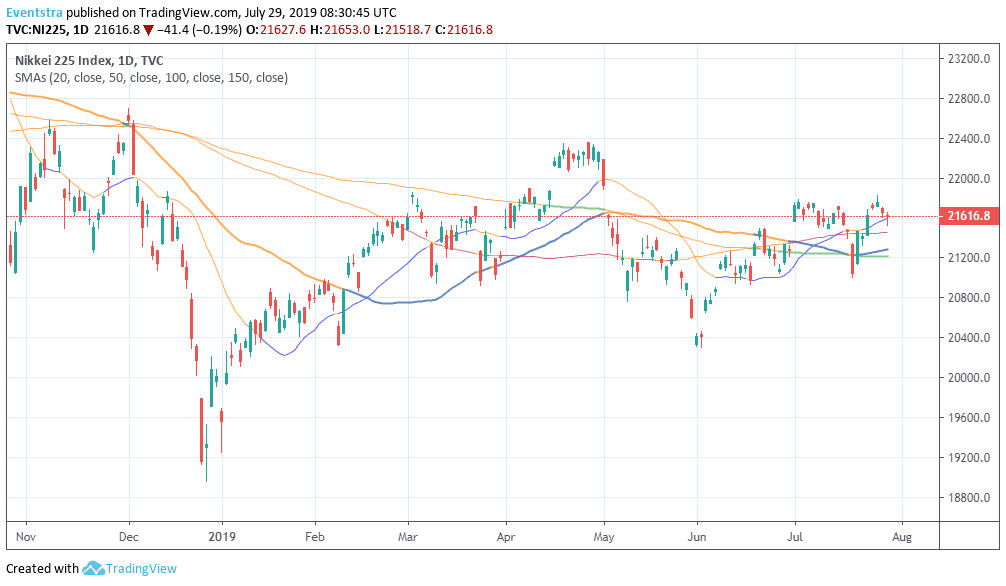

Nikkei 225 finished 0.19% lower at 21,616 as trade tensions between South Korea and Japan escalates after the reports that Japan will remove South Korea from its list of most-favored trading partners. Japanese government lowered the FY 2019 real GDP growth estimate from 1.3% to 0.9%. Earlier today, Japan Retail Trade (year over year) came in at 0.5%, beating forecasts of 0.2% in June, Retail Trade s.a (month over month) registered at 0%, below expectations (0.8%) in June and Large Retailers’ Sales registered at -0.5% topping expectations of -0.7% in June.

The positive momentum for Nikkei 225 is still intact as the index holds above all the major daily averages. First support for the index stands at 21,591 the 20 day moving average, while another barrier is at 21,283 the 50 day moving average. On the upside resistance stands at 21,807 the high from July 25th.

In Asian forex markets USDJPY trading 0.03 percent higher at 108.66, the Aussie dollar trades 0,05% lower against greenback at 0.6905 while Kiwi also trades lower at 0.6624 versus USD. Gold is adding 2 dollars at 1,417, while crude oil is 0.11 percent lower at $56.11 per barrel.Don’t miss a beat! Follow us on Twitter.