- Summary:

- Asian indices and Nikkei 225 finished higher as stock investors sentiment improves after news that U.S. trade negotiators will likely visit China next week

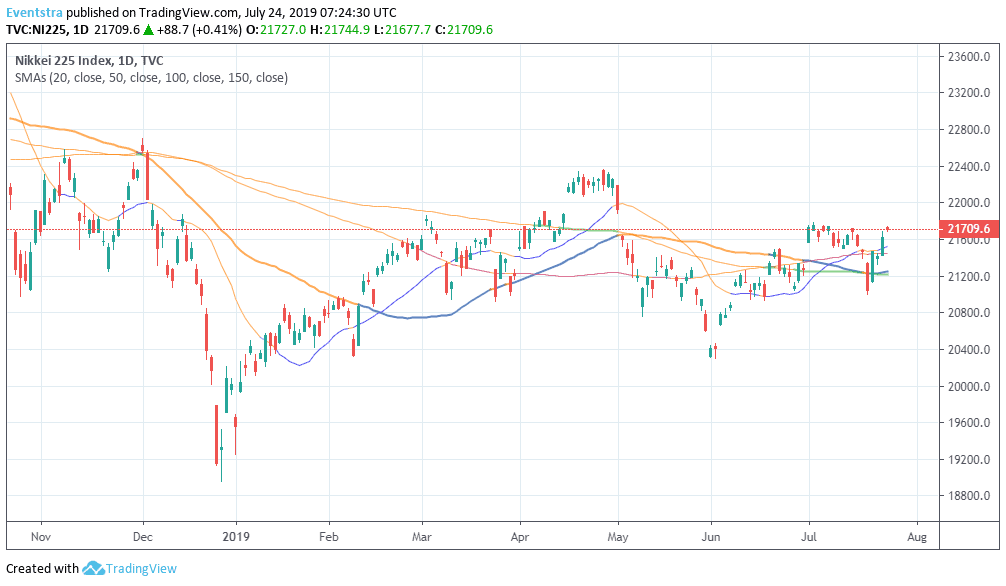

Asian indices and Nikkei 225 finished higher as stock investors sentiment improves after news that U.S. trade negotiators will likely visit China next week for their first face-to-face talk with Chinese officials since the G20 meeting. Traders’ attention focused on the Fed policy meeting next week as hopes of a 50 basis point cut to interest rates fade away. The Hang Seng finished 0.93 percent higher at 28,730, the Shanghai composite ended 1.01 percent higher to 2,929 and the Singapore Straits Times index finished 0.23 percent higher at 3,380. Aussie stocks trading 0.79 percent higher at 6,777. The Australian CBA – Markit Purchasing Managers’ Index for July showed that the Manufacturing PMI lagged behind 52.0 prior to 51.4 and the Services PMI also trailing the 52.6 earlier with 51.9 reading, resulting into 51.8 Composite PMI versus 52.5 previous readouts. Skilled vacancies fell 6.7% year-on-year in June. In Japan the main benchmark, Nikkei 225 finished 0.44 percent higher at 21,745. Japan Nikkei Manufacturing PMI came in at 49.6 below expectations of 49.7 in July.

In Asian forex markets USDJPY trading 0.09 percent lower at 108.10, the Aussie dollar trades 0.29% lower against greenback at 0.6985 while Kiwi trades lower at 0.6698 versus USD. Gold is adding 3 dollars at 1,421, while crude oil is 0.35 percent higher at $56.95 per barrel.

Facebook Earnings July 24: Download our free FB earnings preview report today.

Don’t miss a beat! Follow us on Twitter.