- Summary:

- The Nikkei 225 index popped by more than 500 points on Tuesday as global stocks rebounded. The index is trading at ¥28,475

The Nikkei 225 index popped by more than 500 points on Tuesday as global stocks rebounded. The index is trading at ¥28,475, which was above last week’s low of ¥27,593. All but 7 companies in the Nikkei index are in the green.

Softbank leads

Softbank Group is one of the biggest companies in Japan. The stock has declined in the past eight straight days as investors reflect on the company’s exposure to Chinese companies. For example, Alibaba’s shares have cratered by more than 50% this year.

At the same time, DiDi, the Chinese ride-hailing service was forced to delist from New York. While Hong Kong is also a liquid market, the company’s long-term potential will be curtailed. Softbank has also been affected by the latest decision by the Biden White House to sue Nvidia’s acquisition of Arm Holdings.

The company has also struggled because Bytendance, the parent of TikTok has failed to go public in the United States. Coupang share price has crashed by more than 25% as a public company.

The Softbank share price has jumped by more than 10% today as investors rush to buy the dips. It is the biggest gainer in the Nikkei 225 index today. Other top gainers TOTO, Mitsui, Marubeni, and Mazda, among others.

Nikkei 225 analysis

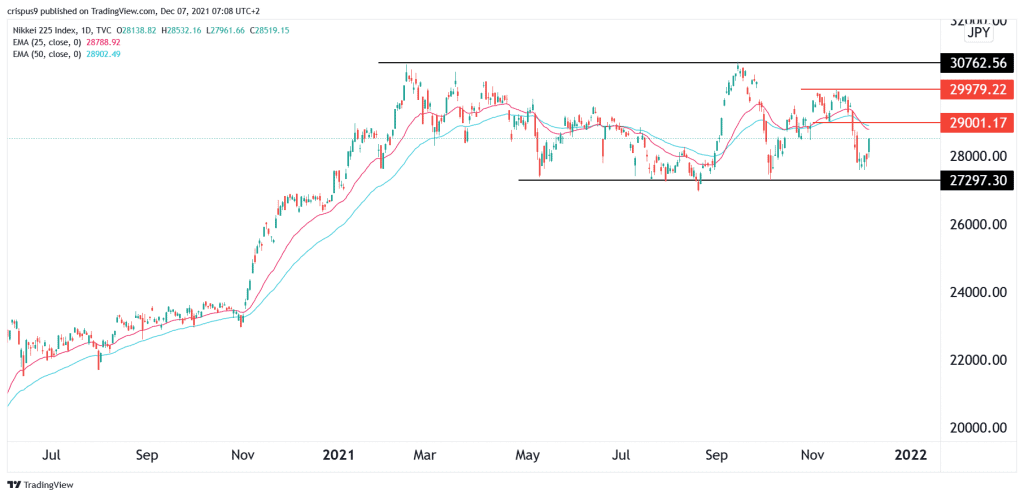

In my last article, I warned that the index would crash below 28,000, which was accurate. The daily chart shows that the Nikkei 225 has moved sideways in the past few months. It has found support and resistance at ¥27,297 and ¥30,700. The index has also moved slightly below the 25-day and 50-day moving average. Indeed, the two MAs have formed a bearish crossover pattern. The index has also formed what looks like a head and shoulders pattern.

Therefore, I think that this rebound is a dead-cat-bounce. As such, the Nikkei index will likely rise to the ¥29,000 level and resume the bearish trend. This price is along the chin of the double-top pattern.