- Summary:

- Which are the best and worst components of the Nikkei 225 this year? We explain why they have dropped and what to expect.

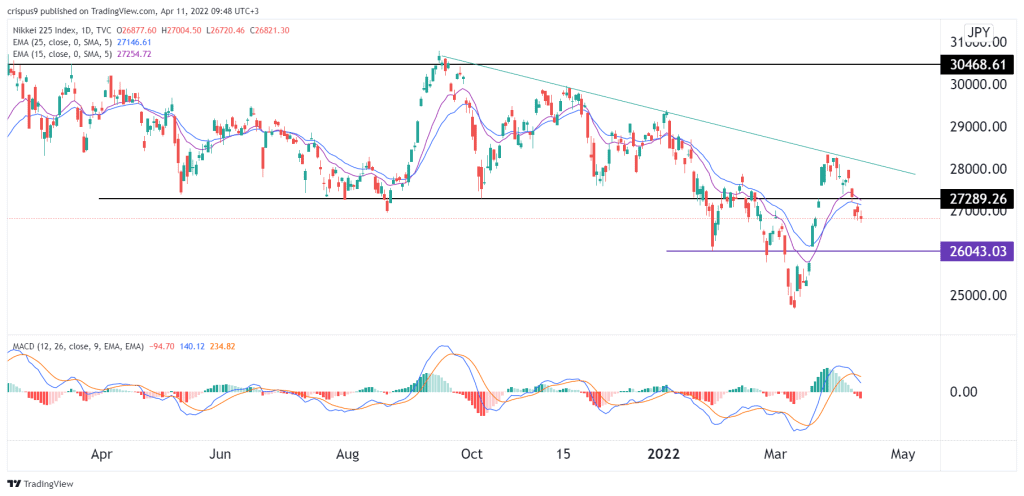

The Nikkei 225 index has been under pressure as investors worry about the Japanese economy in the past few days. As a result, the NI225 index has dropped to ¥26,821, about 5% below its highest level in March. Moreover, it has retreated by 8.8% from its highest point this year. This performance has mirrored other leading global indices like the Dow Jones, Hang Seng, and the DAX index.

Nikkei index best and worst stocks

The best performing stock in the Nikkei 225 index is Pacific Metals, whose shares have risen by more than 72% this year. The stock has jumped sharply because of the surging metal prices as the conflict in Ukraine has continued. In addition, the nickel price has gone parabolic because of the significant amount that comes from the Russian market.

The second top performer in the Nikkei index is JGC Holdings Corporation. The company has done well because of the strong performance of oil and gas prices. It has benefited because it counts the largest companies in the industry as customers. Other top stocks in the Nikkei 225 are Mitsubishi Electric, Tokyo Electric Power, Konami, and Mitsubishi UFJ Financial. Firms like Sumitomo, Takeda, Mitsui, and Seven &I are other notable gainers.

Many Nikkei 225 constituents have been in the red this year. Omron Car, Hino Motors, Nippon Sheet Glass, and Denso Corporation have the worst performers. These stocks have crashed by more than 25% this year. Other notable laggards are Recruit Holdings, Sony, Bridgestone, and Nissan, among others.

Nikkei 225 forecast

The daily chart shows that the Nikkei 225 index has been in a strong bearish trend in the past few days. The index has moved below the important resistance level at ¥27,290, about 8.7% above the lowest level this year. In addition, it has moved below the 25-day and 15-day moving averages, and the descending trendline is shown in green.

Therefore, the index will likely continue retreating as bears target the next key support level at ¥26,000. On the flip side, a move above the resistance level at ¥27,290 will invalidate this view.